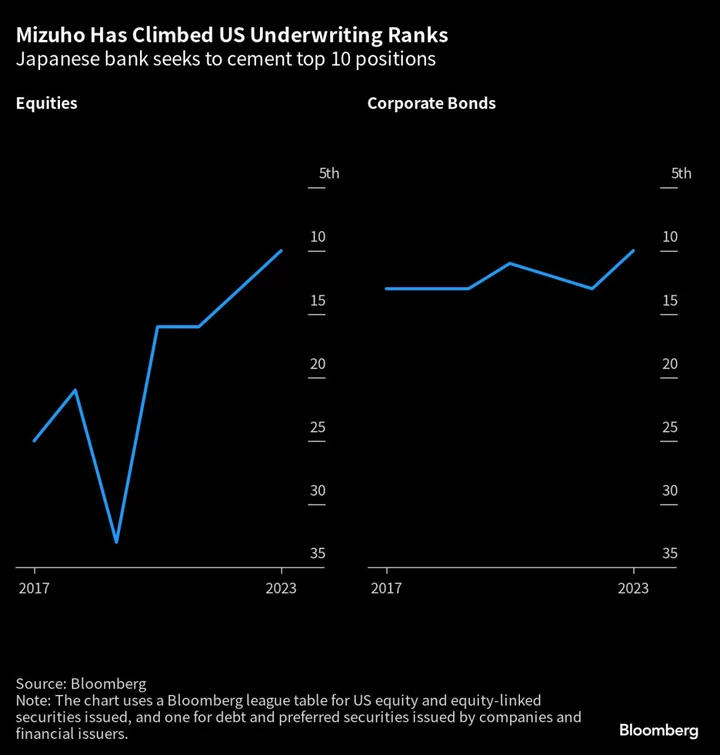

Mizuho Financial Group Inc.’s securities arm is boosting hiring in the US as it seeks to cement its position among the top 10 stock and bond underwriters in the lucrative market.

The Japanese bank’s US unit plans to recruit more than 100 people for its investment banking and trading business by the end of March next year, according to Yoshiro Hamamoto, chief executive officer of Mizuho Securities Co.

Now ranked 10th among US equity arrangers ahead of global rivals such as Deutsche Bank AG and HSBC Holdings Plc, Mizuho is seeking to be the first Japanese bank to hold a top 10 spot for a full year.

“I think we have the ability to go further up,” Hamamoto said in an interview in Tokyo.

The bank is pursuing its hiring drive even as a global dealmaking slump prompts giants including Goldman Sachs Group Inc. and Morgan Stanley to cut jobs. Mizuho has made global corporate and investment banking one of its focus areas in a new growth plan, and it recently acquired boutique firm Greenhill & Co. as it allocates more resources to the Americas.

Mizuho Securities USA plans to increase its headcount by 30% by March 2026, Hamamoto said. The unit had 941 employees at the end of March.

The additions this fiscal year will focus on areas including debt capital markets and coverage of technology, media and telecommunications as well as the healthcare and energy sectors, he said. It’s also looking to recruit for fixed-income sales and equity research.

“It’s possible that we will hire people for our equity capital markets business if we land more deals” in the US, Hamamoto said.

Shares of Mizuho rose 2.2% on Tuesday morning to a seven-year high.

US Push

The bank’s rise in the US has accelerated since 2015, when it hired more than 100 people from then-Royal Bank of Scotland Group Plc to expand in a country that generates more investment-banking fees than any other market. Hamamoto said Greenhill will fill in the “missing piece” in Mizuho’s operations through its strength in mergers advisory and industry coverage.

“We are ready to welcome everyone from Greenhill,” he said. “We will show our inclusive culture and pay them respect. We need everyone there.”

Winning more M&A deals will pave the way for Mizuho to capture other relevant business from clients such as debt and stock underwriting, which in turn generates the business of selling securities to investors, Hamamoto said. “We will be able to grab opportunities at the start of corporate action,” he said.

That may be a challenging task during the worldwide rut in dealmaking. The value of mergers and initial public offerings plunged by about $1 trillion worldwide in the first half, one of the worst performances in the past decade.

Hamamoto said that while it’s hard to predict when deals might recover globally, “there are things we ought to do regardless of whether the market is falling or rising.”

Mizuho also wants to cement its position among the top 10 corporate bond underwriters in the US, he said. It is currently ranked 10th, according to data compiled by Bloomberg.

Mizuho Securities earned a record 29.2 billion yen ($202 million) in ordinary income in the US during the quarter ended March 31, filings show.

(Updates with Mizuho shares in the ninth paragraph)