The craze around pricey weight-loss drugs has many people clamoring for these treatments in company-sponsored health plans.

While less than half of large employers currently cover the new generation of obesity drugs, an additional 18% say they’re considering adding them amid surging interest, according to preliminary findings from 1,062 firms surveyed by Mercer, a human-resources consulting firm.

“There are just thousands and thousands of patients reaching out to us,” said James Wantuck, associate chief medical officer at health-services company Accolade Inc. Employers have a tough choice, he said, because the medicines “work really well” but “they’re very expensive.”

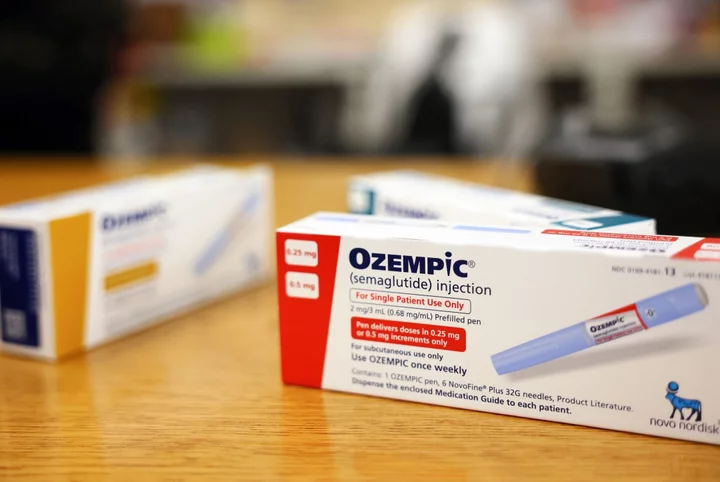

The Mercer survey was conducted before Eli Lilly & Co. won US clearance this week for Zepbound, a version of its diabetes drug Mounjaro that will be specifically marketed to patients with obesity in coming weeks. Both drugs belong to a class of medicines known as GLP-1 receptor agonists. The group also includes Novo Nordisk A/S’s Wegovy, which is approved for obesity, and Ozempic, a diabetes drug that is often used for weight loss. List prices for the drugs range from $936 per month to nearly $1,350.

Read More: New Ozempic Rival Is About to Make Your Weight Loss Drugs Cheaper

Only 7% of large companies cover GLP-1s without limitations like “prior authorizations” which require doctors to do things like fill out extra forms in order for patients to get drugs.

Demand for coverage of obesity drugs comes as companies’ benefit packages are evolving. Nearly two-thirds of employers said they were planning to make “enhancements” to their health and wellbeing offerings for next year, according to Mercer. For example, menopause benefits are increasingly common with 15% of employers offering or planning to offer them next year, up from just 4% a year ago.

Employers also are starting to recognize the toll that caring for aging family members and children takes on workers’ finances and wellbeing. More than three-quarters of large companies surveyed by the Employee Benefit Research Institute said interest in elder and child care benefits has increased since the beginning of the pandemic.

Another area of growing interest is help with student debt — 40 million people in the US collectively owe more than $1.6 trillion — now that payments have resumed after a pause during the pandemic. Eighty-six percent of employers are currently offering or planning to offer student loan debt assistance or tuition reimbursement, according to EBRI.

Read more: The Best Pet Workplaces Offer Bereavement and Pawternity Leave

--With assistance from Madison Muller.