Some Asian refiners are considering buying more crude from Russia and Africa after Saudi Arabia surprised the market by raising prices for its oil following an unexpected pledge to reduce output.

At least three Asian refiners are considering asking for less contracted crude from Saudi Arabia in July, and may tap the spot market for cheaper cargoes, according to people familiar with the companies trading strategies. Barrels could also be sourced from the Persian Gulf, the US or Brazil, they said.

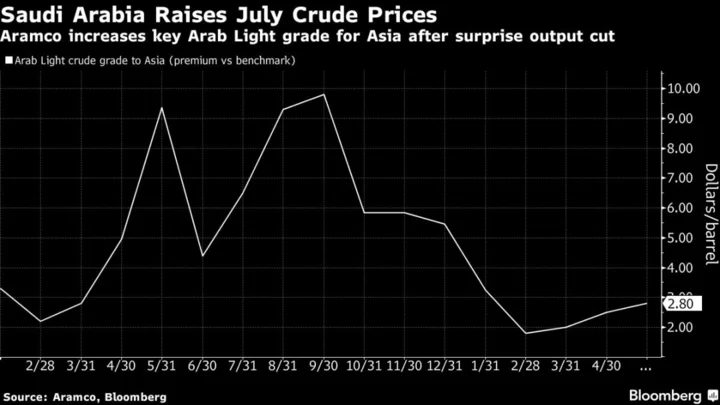

Saudi Arabia increased its official selling prices for all regions for July after the OPEC+ producer pledged extra supply cuts for the same month to stabilize the oil market. Asian refiners are grappling with lackluster refining margins due to weaker demand, and some are mulling curbs to operations.

“This move is going against the market,” said Gao Mingyu, the Beijing-based chief energy analyst at SDIC Essence Futures Co. It will make alternatives such as Russian crude more attractive for buyers, she added.

However, buyers may find it difficult to source spot crude because there are few July cargoes available as the usual trading cycle has passed, said traders who participate in the market. Some Chinese refiners also submitted supply requirements before the pledged output cut and may not be able to change the requested volume due to contract obligations, said refiners, asking not to be named.

Unipec just bought 1 million barrels of US Mars crude, which has similar quality to Saudi barrels, traders said. The purchase helped Mars prices, which traded at a premium to benchmark Nymex WTI prices for the first time in almost a month.

A survey of buyers in Asia prior to the OPEC+ meeting signaled expectations for a price cut, with traders on Monday moderating their estimates after the Saudi pledge to reduce supply but still predicting a price decrease.

“It’s unlikely to impact Indian refiners as currently Middle Eastern supply to India is less than what we used to have in the past,” said Mukesh Surana, the chief executive officer of Ratnagiri Refinery and Petrochemicals Ltd. “Cheaper crude oil from Russia has caused a rebalancing of India’s crude basket.”

In Europe, refineries have bought a record amount of spot cargoes from UAE and Oman for July loading, and the trend is expected to continue when the trading cycle of August starts, said traders involved in the market. The plants are trying to run as much sweet, or low sulfur, crude as they can given that sour crude has become more expensive, they said.

--With assistance from Alfred Cang, Sherry Su, Lucia Kassai and Sheela Tobben.

(Updates with Mars prices in sixth paragraph.)