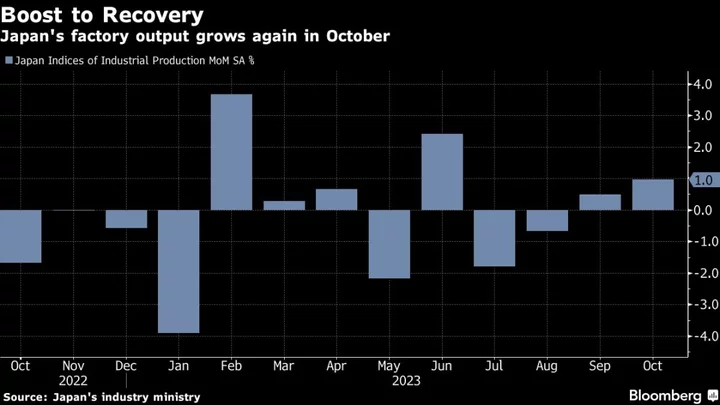

Japan’s industrial production rose more than expected in October, offering a fresh sign of economic resilience as improvement in supply chains bolstered automakers and inventory adjustments underpinned the electronics parts industry.

Factory output rose 1% from the previous month, beating economists’ forecasts of a 0.8% gain, the industry ministry said Thursday. Production increased 0.9% compared with a year earlier, also exceeding consensus estimates.

A separate report Thursday showed that retail sales fell 1.6% in October from September, reversing after three months of gains. Economists had expected the reading to increase by 0.4%. Sales rose 4.2% from a year earlier, lagging estimates. Inflation accelerated for the first time in four months in October, prompting households to pare discretionary spending.

The production figures partly reflected the boost from recovering global supply chains. Trade data for October showed that Japan’s exports held up largely due to a solid gain in shipments of cars, especially to the US. Auto sector output grew 2% versus the prior month even as Toyota Motor Corp. was forced to temporarily suspend operations at some plants after an explosion at a component supplier’s factory.

Other gainers included electronic devices and general machinery.

Auto inventories increased 5.5% in October compared with September, possibly pointing to declines in output in that sector in coming months. Overall inventories rose by 0.8%.

“An improvement in electronics parts boosted production as inventory adjustments take place globally, but I doubt production will pick up further from here given the mixed conditions in the US and European economies,” said Harumi Taguchi, principal economist at S&P Global Market Intelligence. “Auto inventories have increased fast on the back of the recent market improvement, but production may fall down the road.”

The advance in output comes against a backdrop of resilient corporate activity. Confidence among the nation’s large manufacturers picked up more than expected in September versus three months earlier, the Bank of Japan reported in October, while sentiment for non-manufacturers soared to the highest in 32 years. Among factors boosting sentiment is surging demand for chipmaking gear from China.

What Bloomberg Economics Says...

“We expect stronger global demand for semiconductors to continue to underpin production. It should buoy exports of electronic devices and chip-making machines — benefiting those producers as well as Japanese suppliers further down the production chain.”

— Taro Kimura, economist

To read the full story, click here.

The weak yen is bolstering profits for large manufacturers while also boosting the spending power of inbound tourists who are returning in droves, supporting a wide swath of companies in the services industry.

Resilient consumption by inbound tourists helped sustain growth in retail sales, with the number of foreign visitors returning to pre-Covid levels in October. Some economists say the recovery in foreign arrivals has just about peaked, casting doubt on the sustainability of what’s been a consistent bright spot for Japan’s economy ever since pandemic-era travel curbs were eased.

Thursday’s reports will give the Bank of Japan fresh data to review as authorities assess how close the economy is to achieving a positive wage-price growth cycle.

The BOJ noted in its October Outlook report that although exports and production have been affected by a slowdown in the pace of recovery in overseas economies, they have been more or less flat, supported by a waning of the effects of supply-side constraints.

The central bank will hold its final policy meeting of the year next month. Most BOJ watchers expect no change.

(Adds economists’ comments, details from report)