Australia’s tight job market is showing signs of losing steam as 11-year high borrowing costs weigh on labor demand, a trend that if sustained could drive up unemployment and forestall further policy tightening.

While the jobless rate surprisingly fell to 3.6% in September, underlying figures suggest vacancies are being filled and openings are declining. The numbers are critical for the data-dependent Reserve Bank of Australia following its 4 percentage points of interest-rate hikes since May 2022.

The RBA has repeatedly said it will monitor the labor market, inflation trends, consumer spending and global developments to see whether it needs to do more. In recent communications, it has referred to a “turning point” in employment.

New Governor Michele Bullock said in June, when she was still the the deputy, that the jobless rate must climb to around 4.5% for inflation to return to target.

The central bank next meets to discuss the policy rate on Nov. 7 after having paused for four consecutive meetings while reiterating that “some further tightening” may be required to bring inflation to its 2%-3% target in a reasonable timeframe.

The following charts indicate that Australia’s labor market is losing momentum:

Australia’s population has surged over the past year driven by overseas migration after the country re-opened its borders following the pandemic. Economists estimate the working-age population is increasing by around 56,000 people per month compared with a pre-Covid average of about 30,000.

That means monthly jobs growth needs to rise by 37,000 positions for the unemployment rate to hold steady, provided the participation rate remains unchanged, according to Gareth Aird at Commonwealth Bank of Australia.

The average monthly pace of job gains this year has been 29,300.

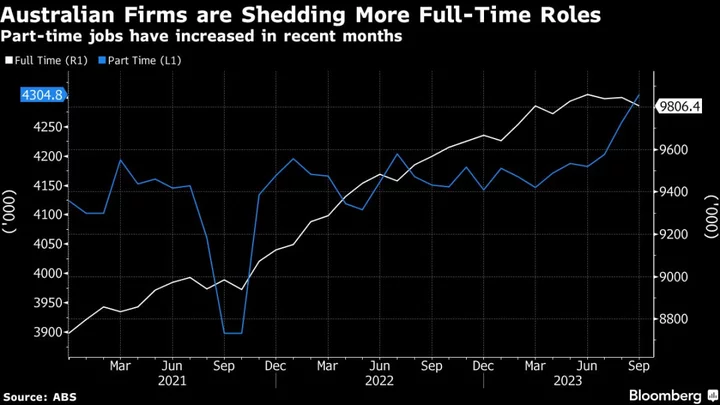

Overall employment growth, in trend terms, has slowed in the past five months from 37,000 in April to 23,000 in September, with full-time jobs stagnating.

The monthly pace of growth in full‑time roles, in trend terms, declined by 1,000 positions in September, while part‑time roles surged by 24,000, Thursday’s report from the statistics bureau showed.

The number of people holding multiple jobs as a share of all employed people surged to a record high in the second quarter, indicating that a soaring cost of living is forcing people to supplement their income.

The figures from the statistics bureau show that young workers, primarily women, are more likely to hold multiple jobs than men.

The participation rate, at 66.7% in September, is at its lowest level since February, suggesting fewer people are looking for work. Had that not been the case, Australia’s jobless rate would have jumped last month, economists said.

“If the participation rate had remained unchanged at 67% in September, rather than declining, then the unemployment rate would have risen to 3.9%,” said Diana Mousina, deputy chief economist at AMP Ltd.

“While there is no specific explanation for why there was a rise in people leaving the workforce in September, this can occur in a slowing labor market if there are discouraged jobseekers who cannot find employment prospects.”