As the label “ESG” ends up among the most hated on Wall Street, the financial cost of ignoring it is making headlines.

In just the past few weeks, a string of textbook environmental, social and governance issues — spanning workers’ rights to extreme weather — erupted in a number of major stocks.

The world’s biggest publicly traded package courier, United Parcel Service Inc., was forced to issue a profit warning that drove down its shares, after it said a tentative labor agreement will add to its costs. The firm agreed to raise wages for some workers, bump up the amount of paid vacation and improve working conditions. That includes installing air conditioning in new vehicles rendered unbearably hot by extreme heat.

UPS’s biggest competitor, FedEx Corp., is also feeling the effect of the “S” in ESG. The courier is pressing delivery contractors to improve safety after mounting accidents contributed to an almost threefold increase in insurance costs over the decade.

Read More: FedEx Pushes Safety Agenda After Accidents Lead to Higher Costs

Then there’s the world’s largest tour operator, TUI AG, which lost more than a tenth of its market value in the first half of August alone after environmental devastation in the form of wild fires in Southern Europe destroyed some of the region’s popular holiday destinations. The company said it will incur costs of about €25 million due to the fires, while analysts at Bernstein said “it remains to be seen” what the full impact will be.

And this week, investors learned that lawsuits are being filed against Hawaiian Electric Industries Inc., alleging its power lines may have exacerbated the deadliest US wildfires in more than a century. Its shares plunged roughly 40%, and its municipal bonds also fell.

While no official cause has been identified for the fire, the utility has faced criticism for not turning off power despite weather forecasters’ warnings that dry, gusty winds could create critical conditions. Researchers have also blamed drought and the spread of non-native grasses that, when dry, help fuel fires. And the ratings of Hawaiian Holdings, the parent of Hawaiian Airlines Inc., were downgraded by Moody’s Investors Service.

Read more: Hawaiian Electric Extends Record Slump With Future in Doubt

“There’s still this cognitive dissonance between using the label ‘ESG’ and accounting for the business impacts from these real-world issues,” said Rob Du Boff, senior ESG analyst at Bloomberg Intelligence. “People see ESG as bad, but when you say that wildfires have financial risks, they’ll agree with you.”

Financial market participants are “realizing that ‘externalities’ that traditionally had no accounting value have real profit and loss, cashflow and balance sheet impacts, as well as real-world impacts on humanity,” said Sandra Carlisle, head of sustainability at Jupiter Asset Management in London, which looks after $65 billion in assets.

ESG was coined back in 2004 by United Nations staffers as a way for investors and bankers to weigh key risks and opportunities such as rising temperatures, worker disputes and corporate malfeasance, and to determine their impacts on profits.

Sustainability purists have since bemoaned the finance industry’s embrace of ESG as little more than a marketing gimmick. Meanwhile, Republicans have attacked ESG, casting it as part of a leftist agenda that threatens American capitalism.

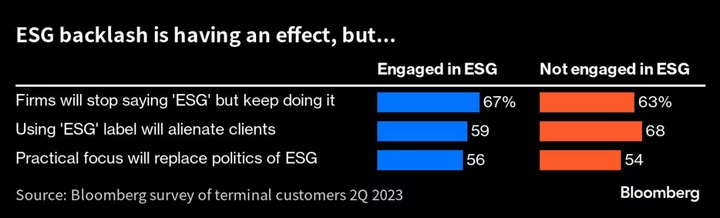

Against that backdrop, investors and bankers are avoiding saying “ESG” in meetings with clients, according to a recent Bloomberg survey. However, they’re still integrating what ESG stands for in their work, the same survey showed.

Calculating the financial impact of environmental and social issues is still nascent, according to Nikita Singhal, co-head of sustainable investment and ESG at Lazard Asset Management in New York.

“We still need better data, better ways to figure out how and where this expresses itself on a balance sheet, an income statement or cash flows,” she said.

Meanwhile, the list of investor losses tied to ESG-related events is long and growing. In July, the largest US telecoms companies, AT&T Inc., saw its shares sink after the Wall Street Journal reported that its cables contained toxic lead. Shares of Verizon Communications Inc. also fell as investors reacted to the news.

Read More: AT&T Says Less Than 10% of Network Has Lead Covered Cables

And the United Steelworkers union is making its presence felt in ongoing merger talks, after declaring that it exclusively supports Cleveland-Cliffs Inc.’s bid to buy United States Steel Corp.

Republicans had dubbed July “ESG month,” as GOP lawmakers held a succession of congressional hearings to push back on Wall Street’s ESG efforts. But then July ended up being the planet’s hottest month on record, forcing investors and businesses to acknowledge the fallout of extreme heat as well as its social ramifications.

Even if the rhetoric surrounding ESG dies down, “the actual underlying issues are only getting louder and louder,” Du Boff said.

--With assistance from Thomas Black.

(Adds fund manager comment in 13th paragraph, United Steel reference in 16th.)