Virgin Money UK Plc plans to buy back a further £150 million ($188 million) of its shares after the lender’s margins continued to benefit from higher interest rates.

The bank will repurchase the shares by May 16, according to a statement Thursday. The buyback is larger than anticipated, as the London-based firm previously said it expected to announce £125 million of buybacks alongside its full year results.

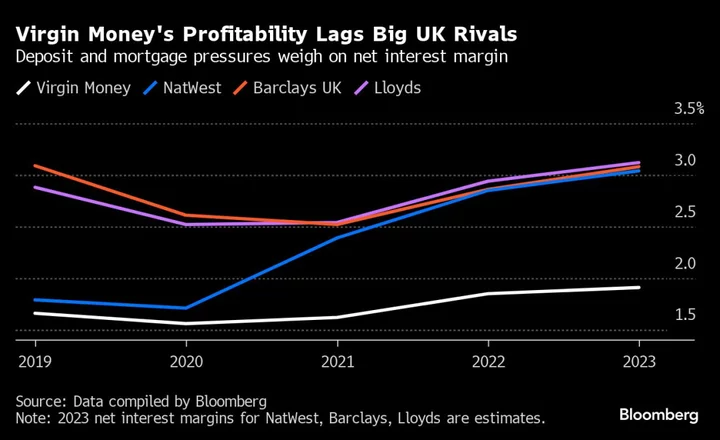

Virgin Money’s net interest margin for the year through September rose to 1.91%, meeting analysts’ expectations, and the lender sees this reaching between 1.9% and 1.95% in the coming fiscal year.

The lender also took an impairment charge of £309 million, compared to last year’s £52 million, though it said for now customers were continuing to pay back their loans on time. Pretax profit fell 42% to £345 million.

And the firm is spending more on “digital investment in financial crime prevention,” meaning executives “now expect to take longer to achieve our double digit statutory return ambition,” Chief Executive Officer David Duffy said in a statement.

With about 6.6 million customers, Virgin Money is Britain’s sixth-biggest lender and the largest of the so-called challenger banks seeking to grab market share from the dominant lenders such as Barclays Plc and Lloyds Banking Group Plc.

While all UK lenders benefited from the Bank of England’s quickest rate-hike series in decades, many challengers’ profit margins have lagged behind the largest firms. Smaller players often lack big current account bases, which don’t pay interest, and typically have to offer higher savings rates to attract depositors and fund lending.