Francois-Henri Pinault, scion of the billionaire French clan that controls a global fashion empire, leapt into a Hollywood torn by labor strife with his latest in a string of deals.

His family’s Artémis holding company, which also controls Gucci-owner Kering SA, agreed to buy a majority stake in talent-management giant Creative Artists Agency in a transaction that values the business at $7 billion.

The purchase marks the third multibillion-dollar acquisition in as many months for Pinault, who as chief executive officer led Kering in buying fragrance maker Creed and a 30% stake in the fashion brand Valentino. The deals come as Gucci, the cash cow behind the Pinault’s family fortune, is struggling through a period of management and design upheaval and lackluster performance.

CAA represents some of the top stars in sports and entertainment, including actress Salma Hayek, who is married to Francois-Henri, the son of Kering’s 87-year-old founder Francois Pinault. The elder Pinault is worth about $38 billion, according to the Bloomberg Billionaires Index.

The purchase will broaden Artémis’s holdings — which also include Christie’s auction house and French vineyards such as Chateau Latour — and potentially give Kering’s brands greater access to the celebrities who increasingly drive luxury sales.

“The CAA deal is a move to diversify,” said Philippe Pele-Clamour, adjunct professor at business school HEC Paris who specializes in family firms. The asset is centered in the US and is focused on being an intermediary in the talent market, much like Christie’s is in the art world, he said.

Luca Solca, a luxury industry analyst at Sanford C. Bernstein, qualified the CAA deal as a “personal matter” for the Pinault family. “They have many different interests beyond Kering, and it appears Hollywood is an obvious one of those, with Salma Hayek being the star she is,” he said by email.

Luxury Links

Whatever the motivation, the links between Hollywood and luxury are longstanding, with brands paying top actors handsomely for their endorsements and designers vying to dress the stars. In announcing the deal, Francois-Henri Pinault praised CAA’s “relationships, and access across key sectors,” from celebrities to social media influencers.

Hayek herself was part of the cast of Ridley Scott’s 2021 “House of Gucci” film. And, while Gucci wasn’t directly involved in the movie, the brand did make its archive available to Scott.

At rival fashion group LVMH, run by Bernard Arnault — the world’s second-richest individual — a 2021 Tiffany & Co. ad campaign featured Beyonce and Jay-Z, while Louis Vuitton, the group’s biggest brand, named music star Pharrell Williams to be its menswear designer. He unveiled his debut collection in June with a star-studded show on Paris’s oldest bridge.

Still, the CAA deal comes at a troubled moment for Hollywood. For the first time in more than 60 years, writers and actors are on strike at the same time. They’re both seeking higher pay and a greater share of earnings from streaming, which has transformed the industry, and protections against artificial intelligence, which is about to do so again.

Luxury brands have felt the impact of the strikes, with stars cutting back on red carpet appearances at movie premieres and events like the Venice film festival, where they typically don fancy gowns and suits from the high-end labels. Aside from Gucci, Kering’s stable of brands includes Balenciaga, Bottega Veneta and Brioni.

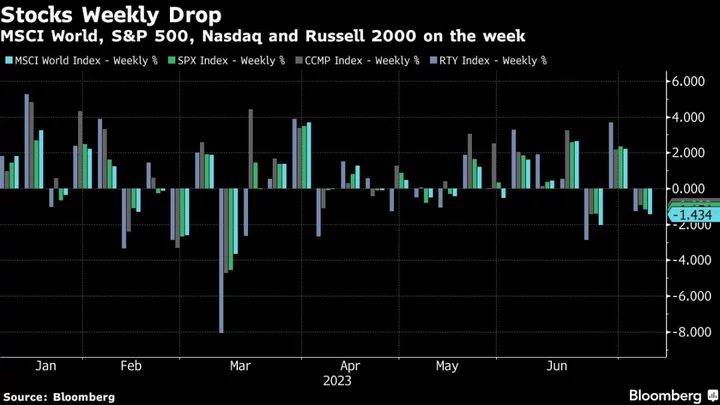

Luxury players, meanwhile, have seen their shares tumble recently on worries about inflation, a slowdown in US demand and a disappointing post-Covid recovery in China. The declines have dented the fortunes of tycoons such as Arnault and the Pinaults.

There were earlier signs the Pinaults were exploring bridges between their luxury empire and Hollywood when Kering’s second-biggest brand, Yves Saint Laurent, announced in April it was launching a movie production company called Saint Laurent Productions, overseen by the brand’s creative director, Anthony Vaccarello.

Long Term

At the time, Vaccarello said he wanted to “work with and provide a space for all the great film talents who have inspired me over the years.” The production arm premiered a short film by director Pedro Almodovar at the Cannes film festival in May.

Kering has also awarded the “Women in Motion” prize at Cannes since 2015, which recognizes female talent in the film industry. This year, the recipient was Michelle Yeoh, who wore a Balenciaga gown at the festival’s premiere of a movie called Firebrand.

The younger Pinault’s track record on acquisitions has been mixed at Kering. In 2011 and 2014, he announced the purchases of Swiss watchmakers Girard-Perregaux and Ulysse Nardin, only to sell both back to management last year after a poor performance.

Whether the CAA acquisition is driven by shrewd financial considerations or personal passions, what’s clear is that Artémis has in the past mostly invested for the long-term and the Pinault family will likely take an active role in oversight of CAA’s management.

“The investment is big enough that even if members of the family have a personal interest in the type of business, I would imagine the acquisition has been thoroughly vetted and assessed for risks,” Pele-Clamour said. “It’ll be interesting to look at its performance in three or four years.”