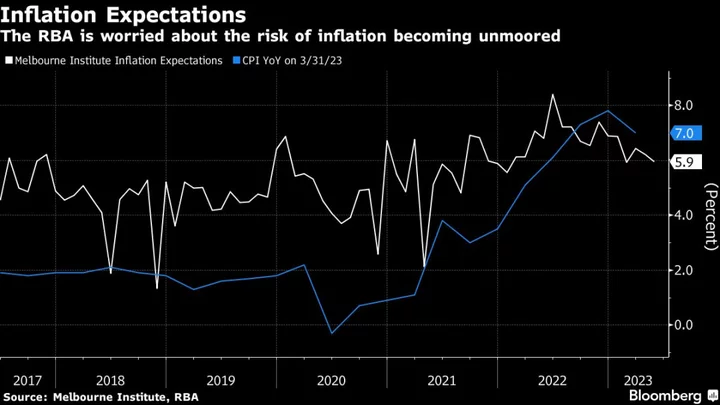

Australia’s central bank is “particularly attentive” to the risk that inflation stays too high for too long, Governor Philip Lowe said, insisting a desire to preserve job gains doesn’t mean the rate-setting board will tolerate prolonged price pressures.

“There is a limit to how long inflation can stay above the target band,” Lowe said in a speech in Sydney Wednesday. “The longer it stays there, the greater the risk that inflation expectations adjust and the harder, and more costly, it will be to get inflation back to target.”

The remarks come a day after Lowe surprised investors for a second straight month with an interest-rate increase to take the cash rate to 4.1% — the highest level since April 2012 — and signaled further hikes “may be required.” The tightening was driven by diminishing confidence that inflation will return to the bank’s 2-3% target in a “reasonable timeframe,” Lowe said in his address.

The governor said recent data had suggested greater upside risks to the RBA’s outlook for inflation to return to target by mid-2025. Policy makers are concerned that stronger services inflation, expectations that electricity costs will rise further this year and soaring rents will see more persistent inflation.

Unit labor costs are also “increasing briskly,” he said, referring to the difference between nominal wage growth and productivity.

“These developments mean that it is too early to declare victory in the battle against inflation,” Lowe said in the speech titled “A Narrow Path.”

The board “is seeking to preserve as many of the gains in the labor market as is possible,” he said. “The desire to preserve the gains in the labor market does not mean that the board will tolerate higher inflation persisting.”

The RBA chief highlighted four factors the board will be paying close attention to in its fight against inflation:

- The global economy, including the strength of China’s recovery

- Domestic household spending amid rising rents and power prices and as many mortgage-holders transition from low-rate fixed loans to variable rates

- Growth in unit labor costs, which he said increased by about 7.5% over 2022, the highest reading over the inflation-targeting period

- Inflation expectations that the central bank doesn’t have many ways to accurately gauge

“We are particularly attentive to the risk that inflation stays too high for too long,” Lowe said. “If that happens, expectations will adjust, high inflation will persist, interest rates and unemployment will be higher and the cost-of-living pressures on Australian families will continue.”

Money markets and a number of economists are pricing in one more hike this year to take the cash rate to 4.35%.