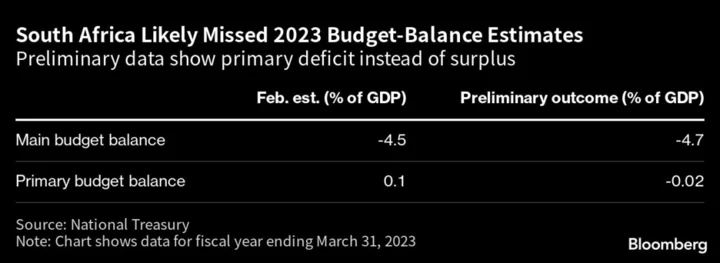

South Africa will likely miss its primary budget surplus target for the 2023 fiscal year by about 8.9 billion rand ($486 million), after revenue collections narrowly undershot estimates due to higher-than-anticipated value-added tax refunds.

Africa’s most industrialized economy recorded a primary budget deficit of 1.53 billion rand, in the fiscal year through March 2023, the National Treasury said in an emailed response to questions, citing preliminary data.

The outcome compares with February’s budget review forecast for a surplus of 6.7 billion rand, which would have been the country’s first positive primary budget balance — where revenue exceeds non-interest expenditure — since the global financial crisis. That projection was later revised to 7.33 billion rand, the Treasury said late Monday in an updated response to questions sent by Bloomberg.

The narrow miss shows that the Treasury continues to face challenges bringing revenue back in line with expenditure years after South Africa’s public finances were weakened by an era of government graft and after the coronavirus pandemic curbed tax income and led to an increase in welfare payouts.

The rand retraced some of its gains to trade 0.6% stronger at 18.2987 per dollar by 4:33 p.m. in Johannesburg. The yield on South Africa’s benchmark 2035 debt climbed seven basis points to 11.49%, the most for similar-maturity bonds in 26 emerging markets tracked by Bloomberg.

The Treasury made the primary budget balance the nation’s most critical fiscal anchor in 2021, instead of a spending ceiling. It previously said achieving a primary surplus will bring its multiyear fiscal consolidation efforts to a close and allow the government to “reconsider the funding of South Africa’s priorities” in a more stable environment. Finance Minister Enoch Godongwana’s February budget showed the Treasury already lived up to that commitment by not proposing expenditure reductions over the next three years.

Preliminary data also shows a main budget deficit of 310 billion rand, or 4.7% of GDP, was recorded for the fiscal year, the Treasury said. The main budget deficit worsened relative to the government’s February projection of 4.5% of GDP after revenue undershot estimates and spending increased more than expected.

“The outcomes are less positive than projected, but still reflect significant improvements in the fiscal position of government compared to recent years,” Edgar Sishi, the head of the budget office, said in an email. “We consider that the outcomes reflect a combination of stronger-than-anticipated efficiency in processing VAT refund requests to taxpayers who qualify and the persistence of a difficult financial environment, with debt servicing remaining an important area of focus for fiscal policy.”

Main budget revenue was 6.1 billion rand less than expected after value-added tax refunds that rose 21.6% from a year earlier lowered total collections, the Treasury said. Main budget spending exceeded estimates due to higher-than-expected non-interest expenditure of 2.2 billion rand and debt-service costs of 1.3 billion rand.

The worse-than-expected outcome means the deficit on the consolidated budget, which includes total spending by provinces, social security funds and selected public entities, could be more than the Treasury’s projection of 4.2% of GDP.

Final outcomes for the key metrics are due to be published in the medium-term budget policy statement scheduled for October. GDP data for the first quarter, which the statistics agency will announce on June 6, will affect the results.

Economists in a Bloomberg survey predict the economy grew by 0.1% quarter-on-quarter in the three months through March. The Treasury declined to share its GDP projection for the first quarter. Its February forecast of 0.9% expansion for the current calendar year is more than three times higher than the International Monetary Fund and South African Reserve Bank’s latest estimates.

--With assistance from Robert Brand.

(Updates first deck headline, first and third paragraphs with new data shared by National Treasury)