Emerging Asian bond investors are turning cautious amid signs that the region’s central banks may not start cutting rates as soon as they hoped.

Market sentiment is starting to shift as rising commodity prices keep the policymakers from letting their guard down on inflation. Signs that the Federal Reserve may keep rates higher for longer are also delaying any potential rate cuts in emerging markets on fears that such a move would pummel their currencies.

“The stronger-than-expected US economy is a cause for concern to bonds and it looks sensible to me that certain EM Asia local rates curves have pared back some dovish pricing,” said Winson Phoon, head of fixed-income research at Maybank Securities Pte in Singapore. We will need to also watch for risks arising from the higher energy and commodity prices, he added.

Falling odds for rate cuts from emerging-Asian policymakers will eliminate a near-term positive catalyst for bonds. Dollar based investors have already suffered a loss of 1.9% on Asian debt so far this month, according to an index of emerging Asian bonds, the worst returns since February.

Here are three charts that illustrate the hawkish turn in sentiment:

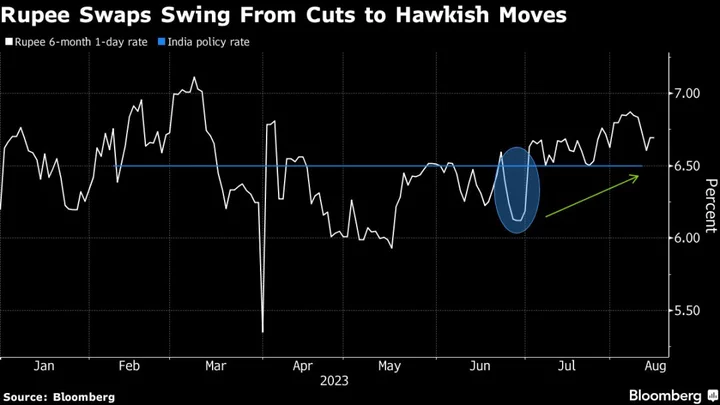

1. India

In India, six-month one-day swap rates are pricing a near 20 basis point rate increase over that time horizon after indicating a quarter percentage point cut over the same period at end-June. That’s because surging food prices pushed July inflation above the Reserve Bank of India’s 2%-6% target band for the first time in five months.

The Reserve Bank of India left its key rate unchanged for a third meeting last week but rising prices are prompting economists to push back their rate cut expectations deeper into 2024.

2. South Korea

South Korean swaps went from pricing a near 25-basis point rate cut over the next 12 months at end May, to expectations of no change over that time horizon. At the July Bank of Korea policy meeting, all six committee members were open to the possibility for policy rates to rise by another 25 basis points to the 3.75% terminal level. The next decision is due Aug. 24.

3. Indonesia

Indonesia’s rate-sensitive two-year yield has risen, widening its spread over the central bank’s policy rate, which was below zero at the end of May. The move signals waning dovish bets for Bank Indonesia, especially as the nation’s currency has been underperforming Southeast Asian peers since that time.