Japan’s economy expanded at a faster pace than initially estimated as businesses ramped up spending, a positive development for Prime Minister Fumio Kishida amid ongoing speculation he may call an early election.

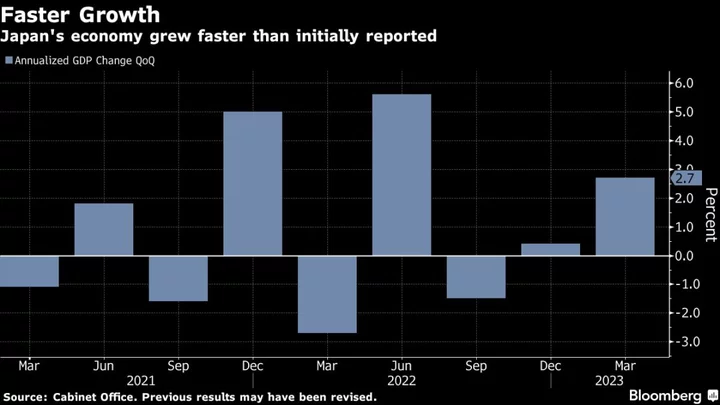

Gross domestic product grew at an annualized 2.7% in the first quarter from the previous three months, revised figures from the Cabinet Office showed Thursday. That beat an initial reading of 1.6% and compared with a 1.9% expansion forecast by economists. Revised data also showed that Japan avoided a technical recession at the end of last year.

A stronger reading in corporate investment was one of the main drivers for the revision, suggesting sentiment among companies remained resilient despite concerns over a slowdown in the global economy. Inventory contribution also boosted figures.

The stronger-than-expected growth comes alongside stocks hovering near their highest levels in more than three decades, factors that Kishida might cite if he decides to call an early poll. The election chatter may keep the Bank of Japan from rocking the boat with adjustments. The central bank meets next week to decide on policy.

The world’s third largest economy is playing catch-up with its overseas peers after the government ended its Covid-19 restrictions and foreign tourists return in droves. The latest GDP reading also eases concerns that a slowing global economy may weigh on Japan Inc.’s sentiment to invest.

The approval rate for Kishida’s cabinet stood at 46.7% according to a JNN poll this week, well above levels earlier in the year after a generally well received Group of Seven summit last month.

What Bloomberg Economics Says...

“Looking ahead, we expect growth to slow in 2Q. Weaker external demand will likely drag on exports and dent business investment. Inflation and falling real incomes should also cap the recovery in consumer spending. Easing supply snags will probably remain a supportive factor.”

— The Asia economists team

For the full report, click here

Going forward, the interplay of inflation and wages holds the key to whether the current recovery will be sustainable and if the BOJ will change its ultra-loose policy. April data showed wages picked up less than forecast and continued to fall after adjusting for inflation, meaning that higher prices may start to weigh on consumption.

That impact may already be emerging, given household spending in April also declined more than expected from the previous year.

(Updates with more details from the report)