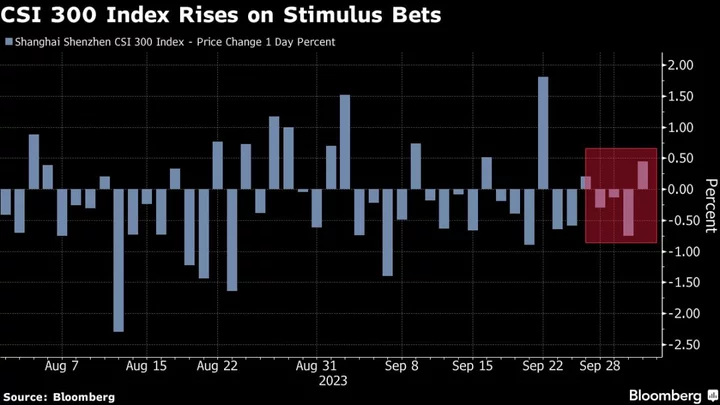

Chinese stocks advanced after a report saying Beijing is planning further support for the nation’s struggling economy boosted sentiment.

The Hang Seng China Enterprises Index rose as much as 2.1% in early trading, as tech shares including Meituan and Alibaba Group Holding Ltd. surged. The onshore benchmark CSI 300 Index rose as much as 0.9%, halting a two-day losing streak this week.

In a fresh effort to shore up the slowing economy, Beijing is considering raising its budget deficit for 2023, Bloomberg reported Tuesday. Policymakers are weighing the issuance of at least 1 trillion yuan ($137 billion) of additional sovereign debt for spending on infrastructure such as water conservancy projects, according to people familiar with the matter.

If the measures materialize, they would mark a shift in the government’s stance as it has so far avoided broader fiscal stimulus and would offer investors a major confidence boost as they’ve been concerned about how far China is willing to go to support growth. Investors had sold mainland stocks after the Golden-Week break following disappointing holiday consumption data.

“The news can help sentiment but the impact will fade, even if it materializes, as investors will think it isn’t enough,” said Redmond Wong, a market strategist at Saxo Capital Markets in Hong Kong. “Soon, the market will also have its eyes on the Third Plenary Session of the 20th Central Committee.”

More private funds have built long positions in Chinese equities in anticipation that a slump in the market is close to an end, Securities Times reported, citing fund managers.

--With assistance from John Cheng.