Don’t get too greedy.

That’s the chorus from many investors who are entering the second half of the year with double-digit stock gains already under their belts.

Global equities have decoupled from a worsening economic backdrop after rising about 13% in 2023, prompting warnings from some of the world’s top money managers that chasing the rally from here on is a risky move. Growing corporate profit warnings are also driving home the message.

“Resilience now is sowing the seeds for fragility down the line,” said Andrew McCaffery, global chief investment officer at Fidelity International. “The ‘best-flagged recession in history’ still isn’t upon us. But that recession will come when the lagged effects of policies eventually take hold.”

Increasingly hawkish central-bank rhetoric and a slew of profit warnings are denting optimism of a soft economic landing, after an action-packed first half that included a US regional banking crisis and a $5 trillion tech bounce powered by the hype around artificial intelligence.

“There’s maybe a nasty surprise in store for stock markets and credit markets in the second half of the year,” Joseph Little, global chief strategist at HSBC Asset Management, said by phone. That could stem from a “combination of the weaker fundamentals set against what is currently expected by market participants, which looks like an incredibly soft landing,” he added.

FedEx Corp. to Siemens Energy AG and European chemical firms have cut or withdrawn outlooks, and there may be more woe in store as the earnings season kicks off in earnest in two weeks. Analysts are slashing profit forecasts globally, following a period of surprising resilience earlier this year.

“I think for many sectors and many industries, this might be the last good quarter,” Luke Newman, a fund manager at Janus Henderson Investors, said by phone, noting that companies may struggle more to pass on cost increases to consumers now, compared with a year ago.

Rising interest rates are likely to remain a key theme for the rest of the year. Expectations of a Federal Reserve rate cut have now been pushed out to 2024, while European Central Bank officials have said the hiking cycle is unlikely to end anytime soon.

Almost 99% respondents in a Deutsche Bank AG survey of 400 market professionals said higher rates will likely lead to more global “accidents,” with most of them expecting the moves to bring fresh strain to financial markets.

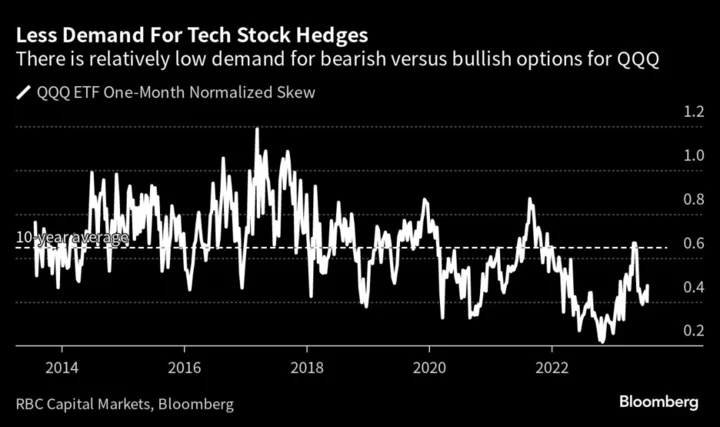

That spells trouble for the rate-sensitive tech sector, in particular, where valuations look rich after an AI-fueled surge. Investors and strategists are also concerned the concentration of this year’s market rally in a handful of megacap tech stocks means that bad news for the group could exacerbate declines for equity gauges overall.

“There’s been an overreaction in the short run” in tech stocks on AI hype, Lode Devlaminck, managing director for global equities at Dupont Capital Management, said by phone. “I do think AI is a game changer for a lot of companies in terms of productivity gains. But looking forward, if we want the market to continue or to sustain the rally, it actually needs to broaden out because it’s too narrow right now.”

Still, worsening conditions don’t necessarily mean stocks will fully reverse their 2023 gains.

Historically, barring the Great Depression in 1929, the S&P 500 has had positive returns every single year when it has gained 10% or more in the first half. Thomas Schuessler, portfolio manager of DWS’s €21 billion dividend fund, sees no good reason to fully hold off from investing in stocks.

“However, I don’t think that we can project the gains of the first six months onto the second half of the year,” he adds.

One factor could exacerbate any moves to the downside in the second half of the year: low trading volume.

While US equities entered bull territory in June, the run came amid thin market participation. The S&P 500 Composite Turnover Index shows a drop in volume every month in 2023 on a year-on-year basis.

Along with the seasonal summer lull, that could accelerate a market correction if traders unwind bullish bets. Patrick Grewe, portfolio manager at Van Grunsteyn, expects a correction in overvalued stocks as rates rise.

“A rock-solid conservative stance should also be maintained in the second half of the year,” he said. “In particular, trying to catch up with the market involves immense risks.”

--With assistance from Michael Msika.

Author: Jan-Patrick Barnert and Ksenia Galouchko