House prices are declining in the overwhelming majority of the UK, as stubbornly high mortgage costs start to bleed into values.

Four in every five local areas saw year-on-year price declines in September, according to property portal Zoopla. That’s up from about 1 in 20 as recently as six months ago, showing buyers and sellers are starting to adapt to the full force of higher interest rates. The figures are based on analysis of house sales in 378 local authorities such as London boroughs and county councils.

“Modest house price falls over 2023 mean it’s going to take longer for housing affordability to reset to a level where more people start to move home again,” said Richard Donnell, executive director at Zoopla. “Income growth is finally increasing faster than inflation but mortgage rates remain stuck around 5% or higher.”

Read more: Survey Suggests UK Landlords Set to Sell Out at Triple 2021 Pace

UK households are facing a barrage of pressures triggered by pricey borrowing and a cost-of-living squeeze. That’s led to a slump in first-time buyer sales, as would-be homeowners remain stuck in ever-pricier rental contracts while mortgages become more expensive.

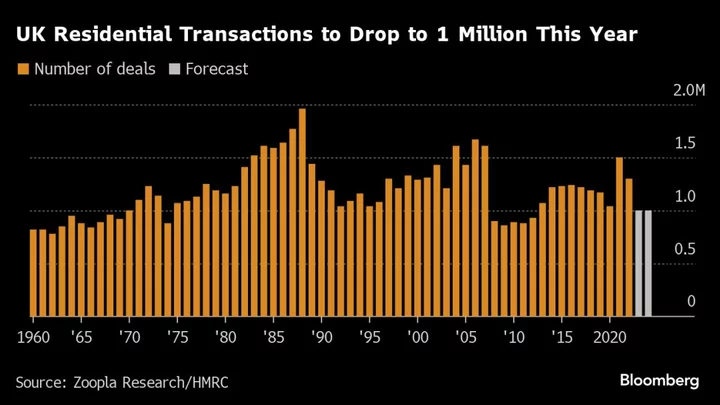

Zoopla expects housing sales to drop by almost a quarter this year compared with 2022, before staying flat at 1 million in 2024.

Read more: UK House Prices Eke Out Modest Increase in ‘Comatose’ Market

To be sure, the pace of Britain’s house price decline is mild so far, less than 5% per year in all districts, according to the report. Zoopla expects to see some markets breach the 5% mark in the coming months as pricing continues to adjust to weaker buying power.

Declining values provide an opportunity for richer purchasers. Cash buyers are set to account for 1 in 3 home sales this year, according to Zoopla, compared with an average of 1 in 5 deals over the past five years.

These buyers will find the best discounts in southern England, where London commuter towns such as Brighton and Canterbury have posted some of the UK’s biggest annual price falls. Home values are holding up better in cheaper markets across northern England and Scotland, with the latter recording 1.2% annual house price growth last month.

Read more: UK Landlords Are Paying 40% More Mortgage Interest Than Year Ago

Zoopla predicts house prices will drop a further 2% over 2024, even if mortgage rates decline to 4.5% by the end of next year. A faster fall in home loan costs would boost sales activity rather than home values, the report added.

“Lower house price falls over 2023 mean the adjustment to higher mortgage rates will run into 2024,” Zoopla’s Donnell said.