Australian central bank Governor Philip Lowe said the rate-setting board will move to eight meetings a year from 11 now, beginning in 2024, while reiterating that policy may need to be tightened further.

Four of the Reserve Bank’s meetings will be on the first Tuesday of February, May, August and November, Lowe said in a speech in Brisbane on Wednesday. The exact dates for the other four will be published “soon,” he added.

The rate outcomes will be announced at 2.30 p.m. Sydney time as is the case currently. Among other changes decided by the board at its July meeting:

- the governor will hold a media conference after each meeting at 3:30 p.m.

- board meetings will be longer, typically starting on the Monday afternoon and continue on the Tuesday morning

- the quarterly economic forecasts will be published alongside the rate decision, instead of the following Friday as is currently the case

- the post-meeting statement announcing the decision will be issued by the board, rather than the governor

- the board will oversee the RBA’s research agenda as it relates to monetary policy and aspects of financial stability

The revamp follows an independent review of the RBA earlier this year that recommended wholesale changes to the central bank’s board structure and decision-making processes.

“Together, these changes are significant and represent a substantial response to the recommendations of the review,” Lowe said

“The less frequent and longer meetings will provide more time for the board to examine issues in detail and to have deeper discussions on monetary policy strategy, alternative policy options and risks, as well as on communication.”

The remarks come as Treasurer Jim Chalmers is due “soon” to make an announcement on whether Lowe will receive an extension or be replaced. The governor’s seven-year term expires in mid-September.

Some opposition lawmakers have warned a move to replace Lowe during a tightening cycle may be perceived as political influence, particularly as his two predecessors received three-year extensions.

Lowe said in Wednesday’s address that the post-meeting press conferences will complement the RBA’s existing communications, including through speeches with question-and-answer sessions. He didn’t address his future in the text.

Lowe’s speech comes a week after the RBA board left the cash rate unchanged at 4.1%, just its second pause in a 15-month tightening cycle and signaled further hikes “may be required.” Lowe reiterated that position in his address.

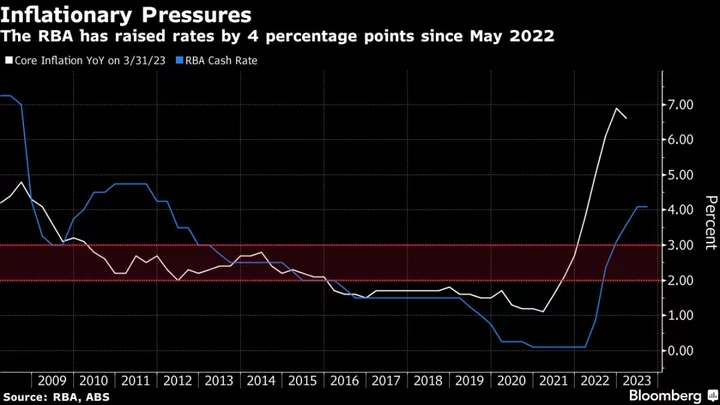

The RBA is assessing the impact of 4 percentage points of tightening since May 2022 and the governor highlighted today it was conscious of the lags involved in rate hikes flowing through the economy.

Lowe reiterated the board’s resolve “to return inflation to target within a reasonable timeframe,” adding it “will do what is necessary to achieve that.”

He said the board will conduct a full review of its central forecasts and risks at its next meeting on Aug. 1 and assess “the many cross-currents affecting the inflation outlook.”

“On the one hand, there are ongoing pricing pressures from several factors,” he said, referring to high capacity utilization, strong growth in unit labor costs, rapid housing rent rises and higher electricity prices. “But, on the other hand, there are several factors working in the other direction, contributing to the easing of inflation.”

“So, it is a complex picture and there are significant uncertainties regarding the outlook,” he said.

Economists surveyed by Bloomberg expect two more RBA rate hikes to 4.6% this year while market pricing implies at least one more increase in October.

Legislative Process

Returning to the changes, Lowe said a number of other recommendations will be considered after the legislative process has been completed and the new Monetary Policy Board is up and running. “This will avoid the current board locking the new board into a particular approach,” he said.

These include:

- the publication of an unattributed vote count

- all board members making regular public appearances to discuss their thinking and decisions on monetary policy

- the establishment of an expert advisory group to engage with the board

- board papers being published with a five-year lag

Lowe highlighted that the current as well as new monetary policy boards recommended by the review are “unusual” by international standards where only two of nine board members are “insiders.”

(Adds further details from speech.)