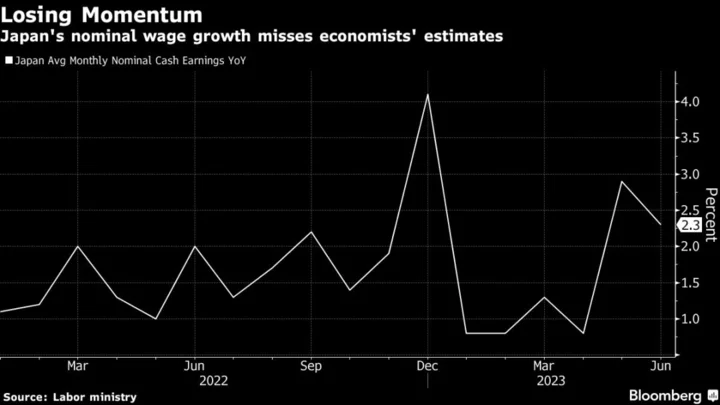

The Bank of Japan is likely to stick with rock bottom interest rates in the near future including at this week’s policy meeting, according to a former deputy governor.

“It’s still too early to call that this inflation has been sustainable and stable,” ex-deputy chief Masazumi Wakatabe said in an interview on Bloomberg TV Monday. “My guess is that at the June meeting there will be nothing.”

The remarks are likely to strengthen market views that the bank will stick with stimulus at the end of two-day meeting Friday. BOJ officials see little need to adjust the yield curve control program for now, according to people familiar with the matter.

Wakatabe, who stepped down in March, also suggested that he doesn’t expect any normalization step in July, though he expects some upward revision to the price view. Next month is the most popular month for a policy shift forecast among BOJ watchers.

Governor Kazuo Ueda’s “big challenge” is to communicate that any potential change in the yield curve control doesn’t mean a shift in overall monetary policy strategy, Wakatabe said. Changing a tool isn’t the same thing as a strategy shift, he added.

“There are the overwhelming cases for continuation of this policy,” Wakatabe said. “But, of course down the road, they may want to change some sort of particularities. Then the question is how do they communicate to change these two things, the strategy part and the tool part. The communication would be very interesting.”

--With assistance from Kathleen Hays.