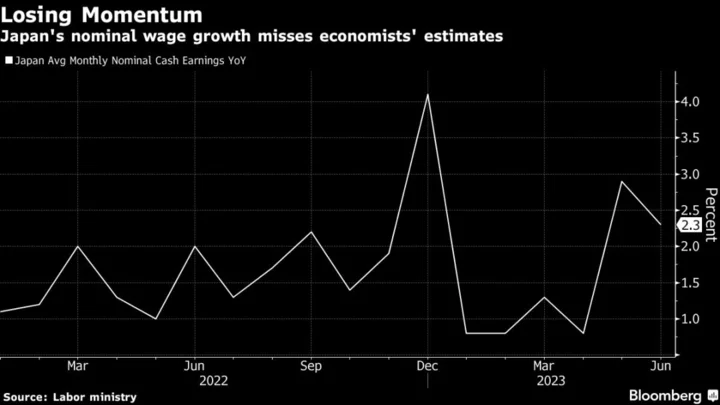

Growth in Japanese workers’ wages unexpectedly slowed in June, indicating the labor market may be losing some steam and clouding prospects for the Bank of Japan’s sustainable inflation goal.

Nominal cash earnings for workers rose 2.3% from the previous year, decelerating from a revised 2.9% clip in the previous month, the labor ministry said Tuesday. The result missed the consensus estimate of 3% growth. The decline in real cash earnings deepened as they fell 1.6% from a year earlier. Economists were expecting a 0.9% decline, the same as in May.

The weak wage results represent a setback for the BOJ, where Governor Kazuo Ueda is watching income trends closely as a key factor that will determine the long-range likelihood of achieving sustainable inflation.

The deeper decline in real earnings may weigh on consumption, forcing retailers to compete for shoppers with sales and other campaigns that keep a lid on prices. For that reason, Tuesday’s data will likely support the BOJ’s recent assessment that price gains exceeding 2% on a sustained basis are still some distance away, and therefore it needs to retain its ultra-easy policy settings for the time being.

What Bloomberg Economics Says...

“Looking ahead, we see wages growing at a similar pace in July, but slowing in August as the boost from larger seasonal bonuses falls away.”

— Taro Kimura, economist

For the full report, click here

Scheduled pay such as salaries grew 1.4% in June, slowing from 1.7% in May, while special payments, which include bonuses, rose by 3.5% after jumping by about 36% a month earlier. Economists were expecting historically high pay increases decided during this year’s spring wage negotiations would continue to be reflected in the June figures.

Japan’s major labor unions and employees agreed on a 3.58% total pay increase during those talks, according to the final tally by Rengo, the country’s largest union federation. A report by the BOJ suggests that more than 70% of the negotiation results should be reflected by June.

Meanwhile, rising wages aren’t translating into a higher propensity to spend. Japan’s household spending fell for a fourth straight month, slipping 4.2% from a year earlier in June, according to a separate report from the ministry. That was a bigger decline than economists were expecting.

Anemic spending bodes poorly for Japan’s recovery trajectory, as private consumption accounts for 60% of the country’s overall economy. The gross domestic product figures for the April-June period will be released next week.

Tuesday’s data came amid growing calls for higher wages across all pockets of the workforce, and some increases are still in the pipeline. A labor ministry advisory panel agreed in late July to target lifting the national average for the minimum wage 4.3% to above 1,000 yen for the first time, in what would be the largest boost since the ministry began keeping records in 1978.

That change, which is expected to kick in from October, would affect about 20% of the labor force, suggesting the largest impact ever on total wages, according to JPMorgan.

As for the public sector, Japanese civil servants may see the biggest base salary increases in more than two decades. The National Personnel Authority recommended Monday that average monthly salaries of public servants be increased by around 2.7% in the current fiscal year. This includes a base pay hike of 0.96%, the largest such increase in 26 years.

(Updates with economist’s comment, more details)