By Lucy Raitano and Mimosa Spencer

LONDON/PARIS Europe's luxury brands may have sparkled at Paris Fashion Week, but investors are questioning their taste for the shares in the face of a Chinese slowdown and interest rate uncertainty.

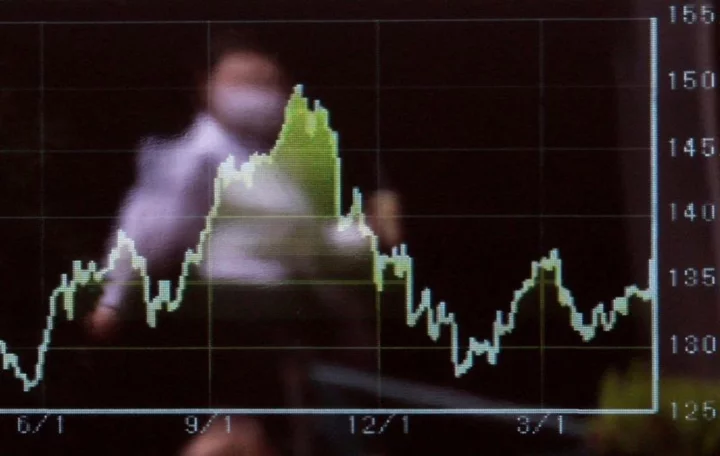

After starting 2023 in vogue, on hopes of a rapid boost in Chinese sales after three years of lockdowns and the post-pandemic U.S. spending boom showing few signs of letting up, the STOXX Europe Luxury 10 index has just posted its biggest quarterly slide since 2020.

Some $175 billion has been knocked off the value of those 10 stocks since the end of March as China's recovery has been rocky and growth is slowing, while high inflation and rising interest rates are forcing U.S. shoppers to tighten their purse strings.

"The sector has de-rated sharply in the last 2-3 months, due to a combination of rising interest rates, investor positioning and in anticipation of earnings cuts," said Bernard Ahkong, co-CIO at UBS O'Connor Global Multi-Strategy Alpha.

Although luxury's "Big 10" index is still up 20% year on year, the third quarter saw its worst quarterly performance on record relative to the STOXX 600, which fell 2.5%.

Ahkong pointed to rising concern over the outlook for luxury consumption across the U.S., Europe and China, a view echoed by Peter Garnry, head of equity strategy at Saxo Bank.

"The recent decline in European luxury stocks reflects the uncertainty over the European economy and also the uneven growth outlook for the Chinese economy," Garnry said.

Just how bad things look may become clearer in the coming weeks as several of the largest European luxury groups release quarterly sales, starting with LVMH on Oct. 10.

THE LUXURY GAP

Although luxury valuations have come down, they are still well above the rest of the market. LVMH's 12 month forward price-to-earnings ratio is around 21, and Richemont's is 15.6, compared with about 12 for the STOXX 600, LSEG data shows.

Nevertheless, in a sign of how their star has waned, Danish drugmaker Novo Nordisk unseated LVMH as Europe's most valuable listed company last month.

The end of the French luxury group's 2-1/2 year-long reign was widely put down to investors losing appetite for luxury stocks as well as the growth of Novo's anti-obesity drug Wegovy.

Some analysts have turned cautious on the luxury sector, with UBS last week reducing its estimates to account for the risk of slowing Chinese consumption.

Morgan Stanley cut 6% from its 2024 earnings-per-share estimate for luxury goods, while Bank of America has slashed its forecast by 7%. It said shoppers in the United States and Europe were spending less than they were following the pandemic.

Credit card data from the United States showed luxury fashion spending was down 16% year-on-year in July and August.

Gerry Fowler, head of European equity strategy and global derivative strategy at UBS, said risks in luxury stocks started to become more apparent in May.

"But we aren't sure that earnings momentum has yet troughed," he added.

HIDDEN GEMS?

Though consensus has turned more cautious, several market players and analysts remain optimistic for the long-term.

"The sector correction has been overly done," said analysts at Bernstein, adding that companies like LVMH that are spending on marketing and easing up on price increases are best-placed in an uncertain economic environment.

Gilles Guibout, head of European equity strategies at AXA Investment Mangers, was cautious earlier in the year due to sky-high valuations, but is now showing interest.

"Up to now, luxury names were seen as a place to hide, it was really consensual. That was also the reason why we were not so keen to be overweight at the beginning of the year," he said.

With valuations now nearer long-term averages, the sector is more compelling for Guibout, although he has stuck to the underweight rating he has held since the beginning of 2023.

"We will wait for the quarterly results, which should confirm that there has been a slowdown," he said.

(Reporting by Lucy Raitano and Mimosa Spencer; Editing by Amanda Cooper and Alexander Smith)