A look at the day ahead in European and global markets from Sonali Desai

Thursday's Goldilocks blend of cooling U.S. inflation and a still toasty jobs market continues to cast a glow across markets, with stocks in Asia extending a rally while lower global yields spur a further unwinding of yen carry trades.

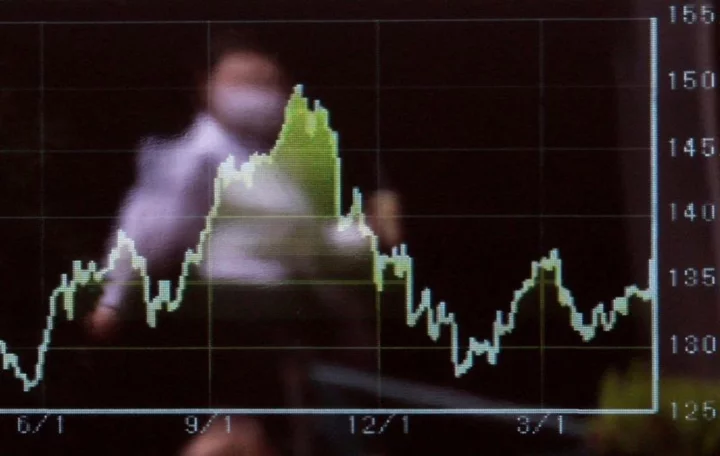

MSCI's broadest index of ex-Japan Asia-Pacific shares was on course for its best week of 2023 and the yen was set to rack up its biggest weekly gain versus the dollar since January.

Indeed, Friday's rise in the yen put it within striking distance of its converging 100-day and 200-day moving averages near 137.00 to the dollar.

Unusually, interest rate differentials are working in favour of the Japanese currency, with 10-year U.S. Treasury yields mired near Thursday's one-month low, while benchmark Japanese government bond yields hit a four-month high of 0.485%, inching closer to the Bank of Japan's implicit 0.50% ceiling.

The dollar remains on the back foot as a result, including against Asia's other troubled currency, the Chinese yuan, which drew some rousing commentary from the People's Bank of China.

The Reserve Bank of Australia was also in the spotlight in Asia, with the much-anticipated announcement of its next governor. While the appointment of Deputy Governor Michele Bullock as the central bank's new chief grabbed plenty of headlines, the Australian dollar and bond yields barely reacted to what was widely viewed as a sign of evolution, not revolution, for policymaking.

The rest of the day is light on economic data with euro zone May trade, U.S. export and import prices and University of Michigan consumer sentiment the main releases.

But it's a bumper day for bank earnings as JPMorgan Chase, Citigroup, Wells Fargo and BlackRock are all due to report second-quarter results.

Another event that's sure to attract much broader interest will be a widely expected strike by Hollywood actors, joining film and television writers, in what could make for a lean fall viewing season.

Key developments that could influence markets on Friday:

Euro zone trade data

European Central Bank Vice-President Luis de Guindos participates in ECOFIN meeting in Brussels

U.S. export and import prices, University of Michigan consumer sentiment and inflation expectations

Earnings: JPMorgan Chase, Citigroup, Wells Fargo, BlackRock

(Reporting by Sonali Desai; Editing by Edmund Klamann)