Tencent Holdings Ltd. has fallen out of favor with mainland Chinese investors burned by volatility and sentiment-driven trading. Getting them back on side may prove elusive.

For the first time since 2021, onshore investors have sold Tencent shares on a net basis for two months in a row, according to Bloomberg’s calculations of exchange data. In July, mainland investors offloaded HK$2.9 billion ($375 million) through trading links between Hong Kong, Shenzhen and Shanghai exchanges.

A former retail trader favorite and China’s most valuable company, Tencent has seen its fortunes wane as concerns about the company’s outlook and selling by its largest shareholder rattle investors. Onshore investors are a pillar of support for the stock and their withdrawal is likely to add to the pressure when shares are struggling to recover from a five-year low in October.

“Mainland investors all agree it’s cheap, but the price moves of 2022 have just proven that things can go quite extreme in the Hong Kong market,” said Cai Dian, a fund manager at Beijing Eastern Smart Rock Asset Management. He was bullish on the stock as well as other Chinese tech shares over the last two years.

The company is still making money, but it’s not a good time to buy given that selling by its largest shareholder is weighing on the stock, he added.

China investors have been known for their long-standing support for Tencent since the stock was listed in Hong Kong nearly two decades ago. They helped cushion the blow when foreign investors fretted about Beijing’s crackdown on the private sector back in 2021 and also when the company’s biggest shareholder Prosus NV announced plans to offload its stake in June.

But they’ve had enough. The stock remains too volatile and the price doesn’t trade according to fundamentals, they say. Since pulling out of the market in June, Tencent’s shares have gained about 15% to underperform a 28% jump in the Hang Seng Tech Index. This means that Tencent is missing out on a rally fueled by recent policy pledges for the sector that’s sent the China tech into a bull market just last week.

“Southbound selling will, to some extent, hinder the rebound of Tencent. The stock has underperformed in the rebound,” said Willer Chen, senior research analyst at Forsyth Barr Asia Ltd. Investors may have moved out of Tencent to buy some higher beta names amid the risk-on sentiment in the China market recently, he added.

And it’s not just domestic traders who want out. Tencent’s put-to-call ratio, which underscores bearishness of a stock, has picked up since June after a sharp pullback earlier this year.

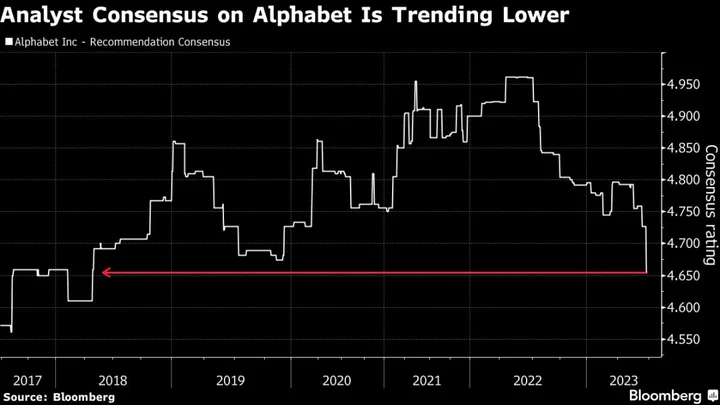

The next test will be Tencent’s second-quarter earnings due mid August, and there are signs that the outlook may improve. The Internet firm is expected to report a 14% year-over-year rise in revenue, accelerating from a quarter earlier, thanks in part to solid gaming revenue growth. Analysts also remain optimistic about its prospects, given the stock has 70 buys and just one sell rating, according to data compiled by Bloomberg.

But JPMorgan Chase & Co. notes that while the company should deliver a “solid quarter,” it may take time for share prices to recover given the weak sentiment.

“We will see signs of increasing caution coming into the sector through the second half,” said Robert Lea, Bloomberg Intelligence analyst. “While second-quarter numbers look to be in the bag for most Chinese Internet companies including Tencent, I think expectations are still too high and see a risk China’s Internet companies could disappoint into the fourth quarter.”

Top Tech Stories

- Amazon.com Inc. will double the number of US same-day delivery facilities in the “coming years,” the company announced Monday, an investment executives are counting on to maintain Amazon’s lead in the $1.4 trillion online shopping market.

- Apple Inc.’s main supplier, Foxconn Technology Group, is planning to invest close to $500 million to build two component factories in India as part of a steady diversification from China.

- AT&T Inc.’s human resources chief, Angela Santone, will leave the company at the end of September, just as the telecommunications giant is eliminating thousands of jobs as part of a newly expanded $8 billion cost-reduction program.

- A federal judge in New York split with another judge who earlier this month ruled that a Ripple Labs token was not a security when sold to the public on secondary markets, adding to uncertainty over cryptocurrency regulation.

Earnings Due Tuesday

- Premarket

- Gartner

- Zebra Tech

- IPG Photonics

- Sirius XM

- Global Payments

- Postmarket

- AMD

- SolarEdge

- MicroStrategy

- Blackbaud

- Unisys

- Electronic Arts

- Match Group

- Lumen Technologies

--With assistance from April Ma and Mengchen Lu.