Grab Holdings Ltd. is preparing its biggest round of layoffs since the pandemic, as the internet company faces stiffening competition in ride-hailing and meal delivery across Southeast Asia.

The reductions are set to be announced as soon as this week and are likely to surpass a 2020 round that shrank staff by 5%, or about 360 employees, according to people familiar with the matter. The final number is under discussion and could fluctuate as conditions change.

While Singapore-based Grab leads Southeast Asia’s ride-hailing and delivery markets, it has yet to reach profitability as it spends on growth and competition from rivals such as Indonesia’s GoTo Group weighs on prices. Shares of Grab have slumped about 70% since its stock-market debut in New York in late 2021, even as it has reduced its losses and pledged to report a profit on an adjusted basis by the final quarter of this year.

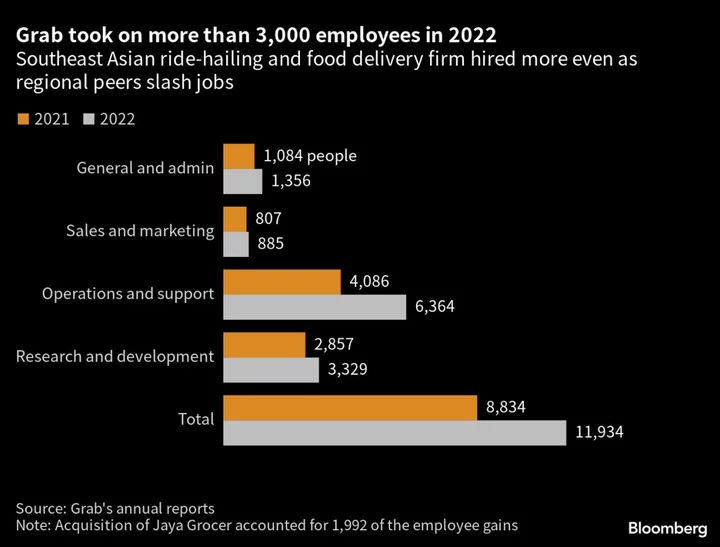

The cuts suggest Grab is succumbing to investor pressure for faster cost reduction. Grab has been slower to slash expenses than regional competitors. As GoTo and Singapore’s Sea Ltd. eliminated thousands of jobs last year, Grab refrained from mass layoffs. It added more than 3,000 staff in 2022, largely because of its acquisition of supermarket chain Jaya Grocer, taking its total headcount north of 11,000.

A Grab spokesperson declined to comment.

Read more: Grab Co-Founder Tan Hooi Ling to Exit Her Operational Roles

Grab is also facing potentially slowing growth as customers grapple with a higher rate of inflation and rising interest rates. While the company reported a narrower quarterly loss last month, it said its gross merchandise value grew just 3% in the three months through March. That’s down from 24% for the full-year 2022. User growth also slowed as competitors lured customers with promotions and lower prices.

Grab’s adjusted losses before interest, taxes, depreciation and amortization in the first quarter narrowed to $66 million, and analysts are predicting its losses will continue to shrink. On a net income basis, it is further away from profitability. In the first quarter, its net loss narrowed to $244 million from $423 million a year earlier.

Read more: Grab Slumps the Most in 14 Months as Consumers Rein in Spending