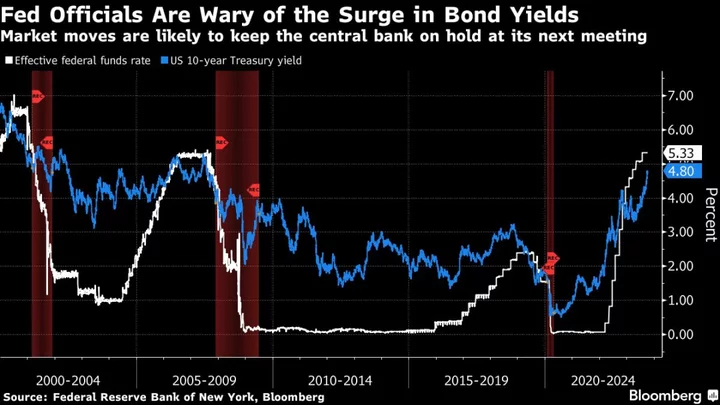

Short sellers have boosted their bets against restaurant stocks in the past month, with concerns swirling that higher interest rates will pinch consumers’ wallets and weight-loss drugs will impact their behavior.

Traders added $815 million to short positions in restaurant stocks over the past 30 days, according to data from S3 Partners LLC. McDonald’s Corp., Chipotle Mexican Grill Inc., Darden Restaurants Inc. and Starbucks Corp. saw the largest increases to short positions during that period. Total short interest in the restaurant industry is $12.2 billion, S3 said.

“If high interest rates continue, we should see discretionary consumer spending take a hit and the restaurant sector to continue its downward price trend,” said Ihor Dusaniwsky, managing director of predictive analytics at S3. The industry’s bottom line will get a “two-fisted blow” if more consumers take GLP-1 drugs — a class of medicines used to treat diabetes and obesity — and their appetites shrink along with their wallets, he said.

The S&P Composite 1500 Restaurants Index dropped to the lowest level since November on Friday after a surprise jump in the pace of hiring fueled speculation that the Federal Reserve will raise interest rates again this year. Investors are concerned about the impact of appetite-suppressing drugs on restaurants’ sales, adding to pressure on the group. The restaurant gauge edged higher by 0.4% on Monday.

Read more: Ozempic Alarm Bells Ring as Companies Weigh Hype vs. Reality

Bank of America Corp. analyst Sara Senatore downplayed the risk that the broad adoption of GLP-1 drugs poses for the restaurant industry, noting that satiating hunger is often not the primary reason consumers choose to dine out.

“Convenience, taste, and social connections are all reasons that people choose to eat out,” she wrote in a note dated Oct. 6. “We don’t expect those to change.”

Even so, those shorting the restaurant industry have made money recently. While restaurant shorts remain down more than $700 million in mark-to-market losses this year, the past month has marked a reversal of fortune for those betting against the industry, with 97% of every dollar shorted in the group being profitable, according to S3.

“For now, market momentum is favoring the short side of the market,” Dusaniwsky said.

--With assistance from Carmen Reinicke and Janet Freund.

(Updates share-price moves throughout.)