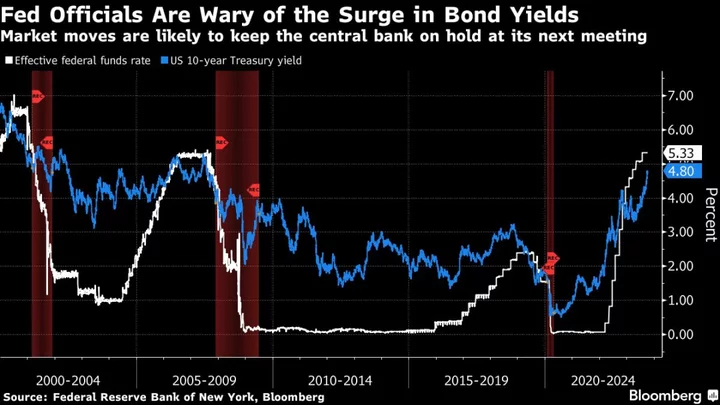

Top Federal Reserve officials are coalescing around the idea that tighter financial conditions after a recent surge in US Treasury yields may substitute for additional increases in their benchmark interest rate.

Fed Vice Chair Philip Jefferson on Monday told a conference that he would “remain cognizant of the tightening in financial conditions through higher bond yields” in assessing “the future path of policy,” echoing similar comments from other policymakers in recent days.

The key question for officials is whether the recent increase in borrowing costs reflects investor expectations for a stronger economy or just extra compensation required to bear interest-rate risk. Parsing it will probably keep them on hold at least through their next rate decision on Nov. 1.

“The markets all of a sudden are doing all the dirty work for the Fed,” said Yelena Shulyatyeva, a senior US economist at BNP Paribas SA. “It seems like the majority, including some of the more hawkish policymakers, are OK with proceeding more cautiously.”

Yields on 10-year Treasury securities have risen about 40 basis points since the Fed’s Sept. 19-20 policy meeting — to 4.8% as of Friday’s close. (Cash trading was closed Monday for the Columbus Day holiday.) Projections published after the meeting showed most officials expected one more rate hike this year — and fewer cuts next year — would be needed to return inflation to 2%.

Earlier on Monday, speaking at the same conference as Jefferson, Dallas Fed President Lorie Logan indicated that if risk premiums in the bond market are on the rise, that “could do some of the work of cooling the economy for us, leaving less need for additional monetary policy tightening.”

Read More: How Rising Rates, US Debt Brought Back Term Premiums: QuickTake

Logan’s comments at the National Association for Business Economics gathering jibed with similar remarks from San Francisco Fed President Mary Daly, who said on Oct. 5 that “if financial conditions, which have tightened considerably in the past 90 days, remain tight, the need for us to take further action is diminished.”

Investors currently see little chance of a rate hike at the Oct. 31-Nov. 1 meeting, and are assigning less-than-even odds to any additional tightening in 2023, according to futures.

Surprise Attack

That’s despite a monthly Bureau of Labor Statistics report published Friday which showed job growth remains much faster than expected. That temporarily pushed the chances of another hike this year above 50%, before a surprise attack on Israel by Hamas over the weekend pulled them back down.

“Jefferson has basically just told you that not only is the Fed on hold, but that they have to take into consideration that higher long rates are starting to slow down the economy,” said Andrew Brenner, head of international fixed income at NatAlliance Securities LLC.

“The Fed has finally recognized the fact that the rise in real rates is having an effect, and doing some of the work they have wanted from lifting policy rates,” Brenner said.

Policymakers aren’t ready to put an official pin on the tightening cycle just yet. Jefferson on Monday said he was “particularly attentive to upside risks to inflation, such as those associated with the economy and labor market remaining too strong to achieve further disinflation.”

Still, inflation has come down this year, and forecasters generally expect a monthly BLS report on consumer prices due Oct. 12 to show it decelerated further in September, according to a Bloomberg survey.

“The improvement in inflation is why they can be patient, and the run-up in yields is the reason why they should be patient,” said Lou Crandall, chief economist at Wrightson ICAP LLC.

A broad increase in borrowing costs across many debt securities amplifies the impact of monetary policy, and raises the risk “of a nonlinear response in terms of fragility and financial stability,” Crandall said.

Author: Craig Torres, Liz Capo McCormick and Steve Matthews