Novo Nordisk A/S takes the spotlight this week, when pharmaceutical peer GSK Plc, its consumer health spinoff Haleon Plc and German chemicals giant BASF SE also report.

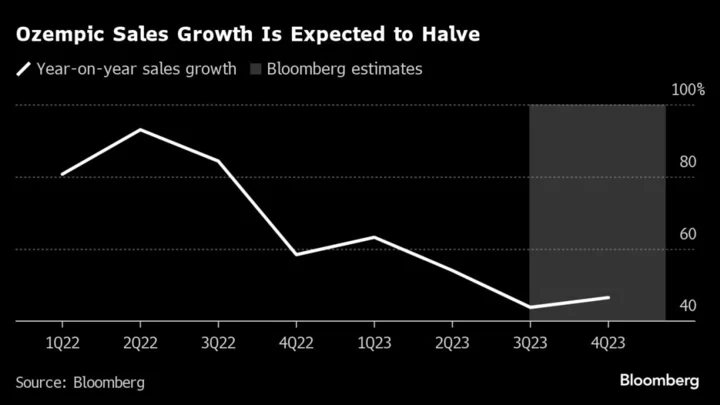

Demand for diabetes and weight-loss wonder drugs Ozempic and Wegovy has catapulted Novo to become Europe’s most valuable listed company. But it has left it scrambling to produce enough, constraints that may hamper sales growth, analysts say.

GSK shares have climbed lately on prospects for Arexvy, the respiratory syncytial virus vaccine it’s rolling out. But the stock has retreated since Haleon’s July 2022 demerger, while Haleon has gained.

Optimism among clothing retailers may be put to the test in updates from Next Plc and Hugo Boss AG as consumer sentiment flags, with sales growth at the German company expected to have almost halved compared with the previous quarter.

Meanwhile, chemical companies Solvay SA and BASF are facing feeble demand across all divisions. BASF’s margins likely contracted in the third quarter, while Solvay’s results may reveal depressed volumes and falling prices. Oil major BP Plc is also due.

Highlights to look out for:

Tuesday: A sluggish economy probably weighed on BASF’s (BAS GY) results, expected at 7 a.m. CET. Limited pricing power is forcing the company to rein in costs to ease margin pressure. Cash generation will be key as global chemical output stagnates and the inventory-to-sales ratio rises toward pandemic levels, BI said. Third-quarter adjusted Ebit is seen down almost 60% at €561 million.

- BP (BP/ LN), due at 7 a.m. London time, should report strong sequential growth in third-quarter adjusted earnings on the back of stable upstream production volumes and new project ramp-ups, according to BI. Another $1.5-billion buyback may be on the cards for the final quarter. Also in focus will be BP’s search for a new chief executive after last month’s surprise exit of Bernard Looney over his failure to fully disclose past relationships with colleagues.

Wednesday: GSK (GSK LN) could raise guidance as sales get a boost from the launch of Arexvy, according to BI. While group revenue probably skidded year-on-year, it likely rose about 7% on a quarterly basis, consensus shows. Arexvy may have brought in $300 million, BI estimates. Litigation risks persist as GSK continues to work through Zantac lawsuits. Citi analysts expect the company will settle all related litigation for $5 billion at the most in the first quarter of 2024, removing a major distraction. GSK recently sold a $1.1 billion stake in Haleon, reducing its holding to 7.4%.

- Next’s (NXT LN) cautious forecast will be put to the test, with analysts keen to see how the high street bellwether holds up against shaky consumer sentiment, which saw the steepest drop since the start of the pandemic this month. Sustained online strength leaves it well-placed for market-share gains, BI’s Charles Allen said. But unusually warm weather has delayed the autumn/winter selling period, posing an added challenge that may lead to early discounting.

Thursday: Novo Nordisk’s (NOVOB DC) recent guidance upgrade has turned the focus to supply constraints on obesity and diabetes blockbusters Wegovy and Ozempic, as well as insurance coverage, according to BI. Wegovy sales growth is seen slowing to about 7% from the second quarter. Watch for more color on data from the Flow trial for semaglutide in kidney disease as well as the company’s plans for the newly acquired hypertension drug ocedurenone.

- Haleon (HLN LN) should deliver organic growth within its guided medium-term range of 4% to 6% in the third quarter. Continued strength in Oral and Pain will offset some normalization in Respiratory, according to Barclays. Sales probably remained strong in the second half, even assuming normal cold and flu demand and a moderating pace in China, said BI’s Diana Gomes. Despite volatile foreign currencies clouding the Ebit-margin outlook, the company’s upgraded 7% to 8% organic growth guidance for 2023 is within reach.

- Boss’s (BOSS GY) refined casualwear can pick up luxury customers looking to trade down, and help the company weather diminishing sales growth, said BI’s Andrea Ferdinando Leggieri. Consensus points to constant-currency sales growth of 16% in 2023, above the top end of its guidance range, but slowing to 9% in 2024 and 8.5% in 2025, respectively.

Friday: Solvay (SOLB BB) is pushing ahead with plans to split into two publicly listed companies and will hold an extraordinary general meeting on Dec. 8 to vote on the proposals. The Belgian chemical maker’s pricing power likely put it ahead of peers last quarter, even as weak demand and slower construction from rising interest rates weighed on volumes. Bright spots include a recovery in the highly specialized aircraft markets and accelerated structural cost-savings efforts, said BI. Still, adjusted Ebitda probably fell more than 20%, consensus shows.

- To subscribe to earnings coverage across your portfolio or other earnings analysis, run NSUB EARNINGS.

- Follow our Top Live blogs for real-time coverage and analysis of the biggest results.

- For more on what’s going on in other regions, see the US Earnings Week Ahead or the Asia Earnings Week Ahead, and see the ESG Week Ahead for a selection of the environmental, social and governance themes that may come up on the week’s earnings calls.

--With assistance from Tuhin Kar, Laura Malsch, April Roach, Christopher Jungstedt and Alexey Anishchuk.

Author: Maggie Shiltagh and Chloé Meley