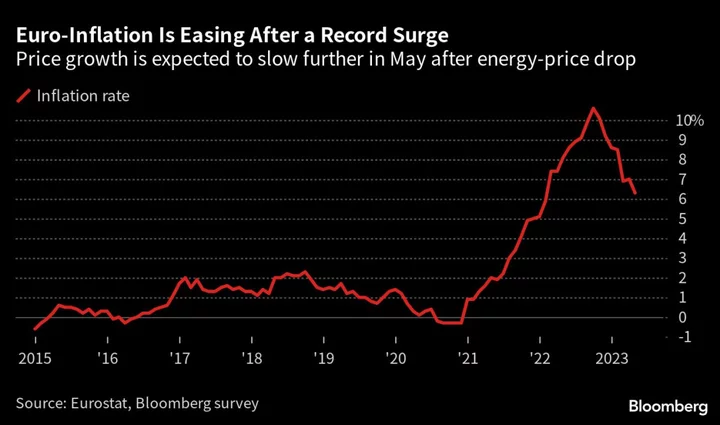

Prices in China are recovering, according to an independent survey, providing more evidence that the worst may be over for the world’s second-biggest economy and easing fears of a Japan-style deflation for now.

The all-sector price index hit 50.9 in September, the highest level in 14 months, according to data company World Economics, which first developed the global Purchasing Managers Indexes now owned by S&P Global.

“This suggests fears of Chinese price deflation ushering in a Japanese style period of very low or negative growth have been overblown,” it said in a statement. “The signs of a resumption of growth in the world’s unquestioned No. 1 growth engine over recent decades are looking a little more positive.”

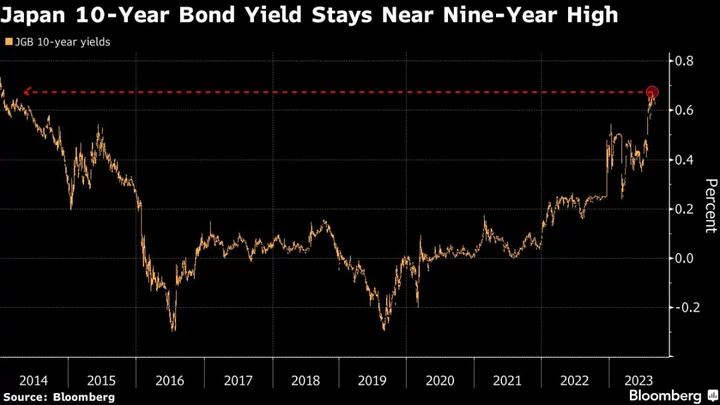

China’s economic recovery has lost steam since April as trade slows and a property crisis weighs on demand, construction activity and overall confidence. It sparked concern that China was entering a “balance sheet recession” like Japan did decades ago. In such a situation, households and businesses start to pay down their debt instead of investing or spending in the economy, leading to a protracted period of deflation and economic sluggishness.

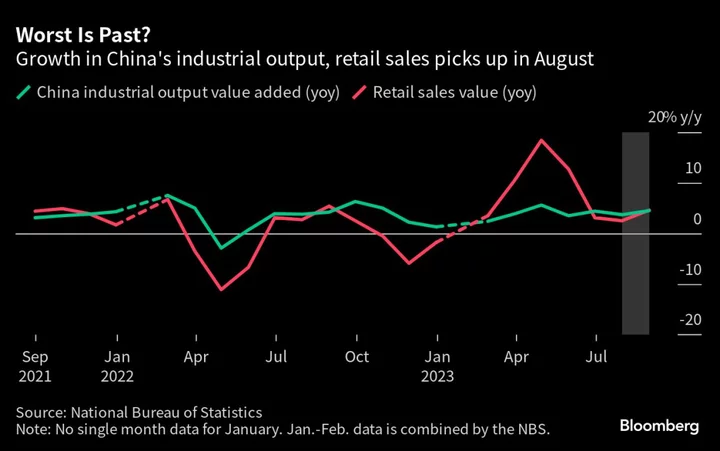

The latest survey adds to early signs of improvement. Official data by the Chinese government also showed the economy picked up in August, thanks to a summer travel boom and a bigger stimulus push. Factory production and retail sales growth exceeded expectations last month and credit demand improved, but challenges remain as the property sector has continued to languish.

The World Economics survey showed the services sector driving the rebound, with the price gauge climbing to 53.2 in September. The measure for manufacturers stayed below the 50 level, which indicates contraction, but at 49, the index was at the highest in eight months, according to the statement.

Meanwhile, the all-sector sales growth index increased to 53.1, buttressed by expansion in the services sector which was at a five-month high, although the manufacturing industry was at best flatlining, according to the survey.

--With assistance from James Mayger.

(Updates with details in fourth paragraph)