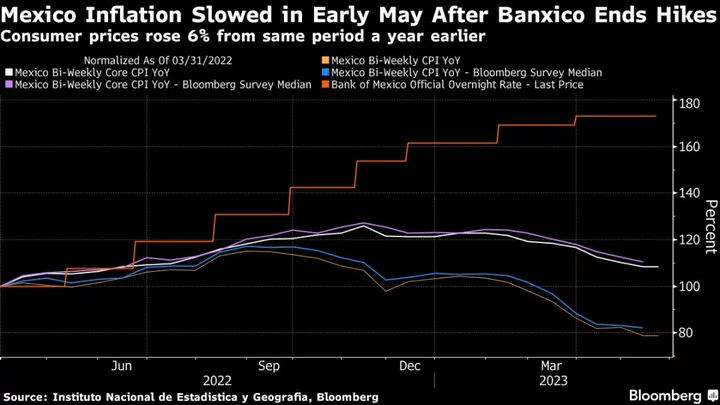

Mexico’s inflation decelerated more than expected in early May, according to a report published less than a week after the central bank ended a record tightening cycle with price pressures beginning to ease.

Consumer prices rose 6% in the first half of the month compared to the same period a year earlier, down from 6.27% in late April, the national statistics institute reported Wednesday. The result was below the 6.13% median estimate of economists surveyed by Bloomberg.

Core inflation, which excludes volatile items like food and fuel, was 7.45% on an annual basis, below both the previous measure of 7.59% and the median estimate of 7.49%.

“The bi-weekly CPI data reinforced Banxico’s message that inflation is headed on a sustained downward trajectory,” said Brendan McKenna, emerging markets economist and strategist for Wells Fargo & Co, adding that the data should give policymakers “confidence that monetary tightening has been effective.”

McKenna said that interest rates will likely remain at restrictive levels and sees rate cuts starting in early 2024.

Overall consumer prices fell 0.32% from the prior two-week period, though core prices rose 0.18% during that time.

The services sector continues to show higher inflationary pressures, with taco shops, restaurants and airline costs as the top consumer price drivers in early May. Food items like fruits and vegetables as well as livestock were on the lower end.

“Inflation continues to be high. It is still double Banxico’s target rate because there are still inflationary pressures that haven’t fully dissipated yet,” said Gabriela Siller, director of economic analysis at Grupo Financiero Base. “What we’re seeing is a gradual decline in inflation.”

Banxico, as the central bank is known, ended one of Latin America’s most aggressive hiking cycles after unanimously deciding to keep its key interest rate steady at 11.25% at this month’s policy meeting. Before the bank’s May 18 decision to hold, policymakers had delivered 15 consecutive increases since June 2021, pushing borrowing costs up 725 basis points.

The bank said in a statement accompanying its rate decision that the inflationary outlook will be “complicated and uncertain” throughout its entire forecast, adding it will need to keep the reference rate at current levels for “an extended period” to bring inflation down to the 3% target.

The peso rose 1%, making it the second-best performing major currency in the world Wednesday. That erased its under-performance over the previous two days amid broad risk-off sentiment in markets on the government’s railway deal.

Economists expect inflation to finish 2023 at 5.1%, according to a Citibanamex survey published this week, up from an early May forecast of 5.02%.

--With assistance from Rafael Gayol and Heitor Caixeta.

(Updates with economist quotes starting in fourth graph.)