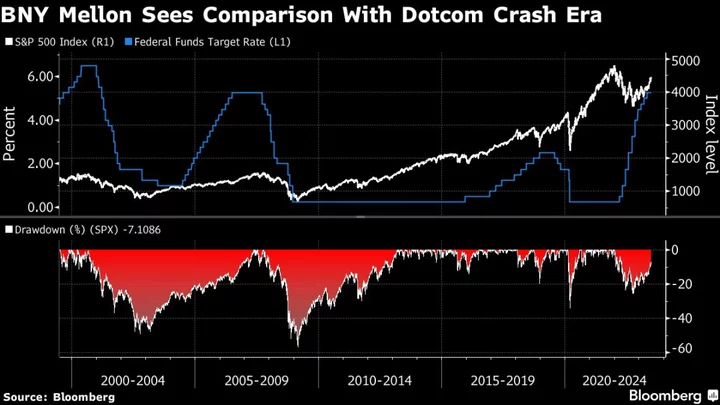

Traders are girding for a volatile start to the week after US and European policymakers signaled interest rates will likely stay higher for longer during their annual confab at Jackson Hole.

Japan’s yen will be in focus when currency markets reopen at 5 a.m. in Sydney. The currency fell to its weakest this year versus the dollar as Federal Reserve Chair Jerome Powell indicated that the US could hike interest rates again, boosting yields on short-dated Treasuries. Australian bonds will give an early indication of whether yields in Asia will follow suit.

Investors are also absorbing China’s latest efforts to support its equities market.

In an address Friday at the Kansas City Fed’s annual symposium in Jackson Hole, Wyoming, Powell said that the Fed is “prepared to raise rates further if appropriate,” even as he stressed that monetary policy will continue to be shaped by economic data. Meanwhile, European Central Bank President Christine Lagarde vowed to set borrowing costs as high as needed and leave them there until inflation is back to its goal.

Treasuries fell after Powell’s remarks, pushing up yields on policy-sensitive two-year paper to 5.09%, while the real yield on five-year notes surged to its highest level since 2008. The yen broke through year-to-date lows to trade near 147 per dollar, renewing questions about whether Japan could intervene to support the currency. Equities closed higher.

“Powell clearly and deliberately restating the macroeconomic case for a hawkish bias in Fed policymaking goes a long way toward affirming the shift higher in Treasury yields over the last two months,” Citi economists Andrew Hollenhorst and Veronica Clark wrote after Powell’s speech.

Powell Signals Fed Will Raise Rates If Needed, Keep Them High

Such dialog surrounding the Fed stands in stark contrast to the Bank of Japan and People’s Bank of China.

Chinese officials have steadfastly intervened to prop-up the yuan, and Japanese authorities have signaled they’re watching the yen’s movements closely.

Speaking at Jackson Hole on Saturday, Bank of Japan Governor Kazuo Ueda did not comment on foreign-exchange rates, but said price growth remains slower than the central bank’s goal, explaining why officials are continuing with their current monetary policy.

Asian currencies have so far dropped 2% against the dollar this month, according to a Bloomberg gauge. The yuan has shed 2% and recently fell to the weakest in nine months as the outlook over the world’s second-largest economy grows dire.

While data on Sunday showed a decline in China’s industrial profits eased in July, the slowing economic recovery and deflation risks remain an overhang for the sector. China also announced measures to support the equities market, lowering the stamp duty on stock trades for the first time since 2008 and pledging to slow the pace of initial public offerings.

“We are much more likely to see a heavier intervention in the renminbi and we might see some verbal intervention in the yen,” said Ed Al-Hussainy, global rates strategist at Columbia Threadneedle Investments in New York. “Both of those things have been ongoing this year, none of those are new, but both the yen and the renminbi are going to be under a lot of pressure.”

What Bloomberg’s Strategists Say...

The yuan could be pressured against the dollar amid multiple headwinds — including negative carry against the greenback, a peaking trade surplus and normalization of tourism outflows. China could step up currency support but this may at best slow the yuan’s drop but not reverse the trend, until the Fed turns dovish and China’s macro data improves.

— Stephen Chiu, BI Chief Asia FX and Rates Strategist, with contributing analyst Chunyu Zhang

For the full column, click here

The Fed’s hawkish stance may also add to the pain of regional equities, with the MSCI Asia Pacific Index already on its way to posting the biggest monthly decline in almost a year.

Global funds have pulled about $5.9 billion from emerging Asia stocks, excluding China, so far in August, according to data compiled by Bloomberg.

In Asia, “high-tech shares will be vulnerable should the US bond yield rise toward 4.5%,” said Toshiya Matsunami, strategist at Nissay Asset Management in Tokyo. Benchmark 10-year Treasuries currently yield around 4.25%. “Companies that are involved with chips for PCs and smart phones will be in a tough position.”

--With assistance from Hideyuki Sano.

Author: Tassia Sipahutar, Matthew Burgess and Carter Johnson