It’s late August, which means we’re headed to Jackson Hole for the Kansas City Fed’s annual symposium, attended by top central bankers from around the world. And as usual, everyone is wondering in particular just what Fed Chair Jerome Powell — who’s expected to speak Friday morning — might have to say.

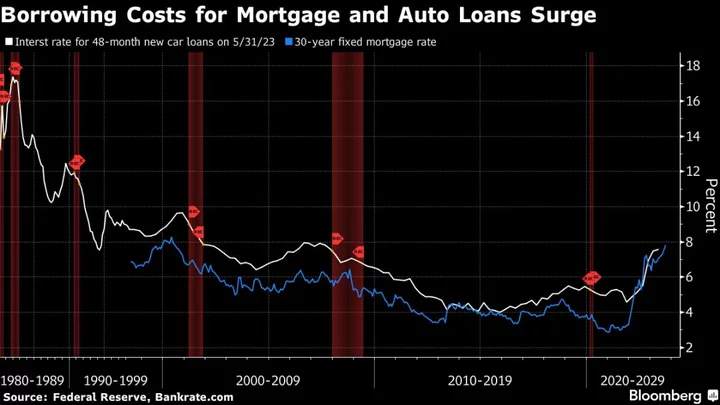

The US central bank just published minutes of its July policy meeting, and the record showed that, at the time, most Fed officials saw significant upside risk to inflation, which in turn may require even more tightening. On the other hand, two also favored holding rates steady, marking the first real hint of disagreement over the way forward that we’ve seen in quite some time.

Since that meeting, key data points have shown price and wage pressures continue to dissipate, which should bolster the case for an end to rate increases. But we’ve also seen ongoing strength in indicators of labor-market activity and consumer spending, which may keep policymakers uneasy about the prospects for ongoing easing of inflation.

Clarity on how Powell might be weighing those developments is a critical question. Beyond that, any clues about how the central bank might be thinking about a plan for rate cuts in 2024 will also garner a lot of attention. Otherwise, attendees will enjoy heady discussions about “Structural Shifts in the Global Economy,” the official theme of this year’s retreat.

What Bloomberg Economics Says:

“We expect Powell to strike a more balanced tone in Wyoming, hinting at the tightening cycle’s end while underscoring the need to hold interest rates higher for longer.”

—Anna Wong, Stuart Paul and Eliza Winger. For full analysis, click here

Elsewhere, purchasing-manager readings might show a broadening divide between economic activity in the euro area and the US. South Africa hosts a summit of BRICS nations, seeking to counter Western dominance of the world order while dealing with their own internal divisions.

Central banks in Turkey, Iceland and Zambia are expected to hike rates, while South Korea and Indonesia may hold and Sri Lanka cut.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

US and Canada

Beyond Jackson Hole, the US economic data calendar is light and includes reports on previously owned home sales, new-home purchases and orders for durable goods.

Further north, retail sales for June are likely to show Canadians are winding down their spending in the face of higher rates, but any continued consumer strength will be a concern for the Bank of Canada.

Prime Minister Justin Trudeau will join his revamped cabinet for a three-day retreat on Prince Edward Island, where they’ll try to hammer out solutions to soaring housing costs that have become a serious vulnerability for their government.

- For more, read Bloomberg Economics’ full Week Ahead for the US

Europe, Middle East, Africa

European Central Bank President Christine Lagarde speaks in Jackson Hole on Friday — with everyone focused on potential hints on what might happen in September. In July she said that both another rate hike or a hold were possible. Economists are counting on the former, while markets are less convinced.

Flash PMIs on Wednesday for the euro area and its top two economies — Germany and France — are predicted to show another round of dismal readings. Germany’s struggles will be on full display at the end of the week: GDP data could revise down a second-quarter stagnation and Ifo numbers may disappoint again.

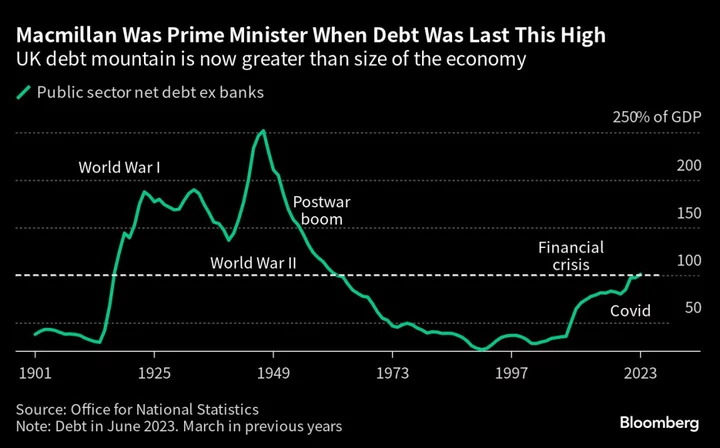

In the UK, public finances figures due on Tuesday are likely to show the budget deficit well above last year’s levels but below the forecasts of the Office for Budget Responsibility. Higher tax revenues resulting from slightly stronger than expected economic growth have given Chancellor Jeremy Hunt a bit of room to maneuver.

On Wednesday, PMI data are expected to show growth in Britain’s private-sector companies ground to a halt in August but remained slightly stronger than much of the rest of Europe.

Turkey’s monetary policy committee on Thursday is poised to raise its benchmark rate for a third straight meeting to rein in inflation, which the central bank forecasts at 58% by year-end. Governor Hafize Gaye Erkan said last month the central bank will stick with a “gradual” cycle of tightening. Early estimates in a Bloomberg survey of analysts point to a hike of 250 basis points, to 20%.

South Africa will be in the headlines all week, with the annual BRICS summit in Johannesburg bringing together the leaders of Brazil, Russia, India, China as well as the host country. All will attend in person except Russian President Vladimir Putin, who’ll participate virtually. The main point of discussion will be the potential expansion of the bloc.

Almost two dozen Global South nations have formally requested to join and a similar number have submitted informal requests. An enlarged BRICS with aspiring members such as Indonesia and Saudi Arabia added could generate about half of global output by 2040, Bloomberg Economics estimates show, bolstering the alliance’s global clout.

On Wednesday, data from South Africa is likely to show annual inflation in July slowed for a fourth straight month toward the 4.5% midpoint of the central bank’s target range, where it prefers to anchor price-growth expectations. It was 5.4% in June.

On the same day, Zambia’s rate setters will likely raise borrowing costs for a third time this year, after inflation quickened to a 15-month high in July, stoked by a surge in the price of corn and other food staples.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Asia

China is expected to cut its prime lending rates on Monday following last week’s surprise decision by the PBOC to trim borrowing costs on its medium-term lending facility. Lower interest rates may help Beijing support its economy, but doubts remain about their potential effectiveness without the use of wider stimulus measures as consumer spending slows, investment slides and unemployment climbs.

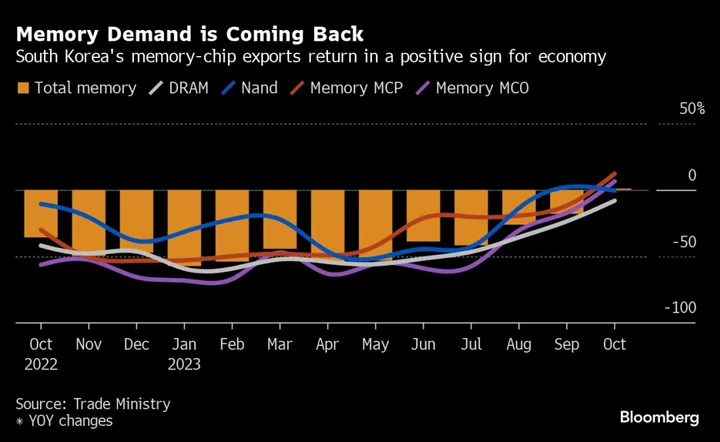

South Korea releases early trade figures for August that will offer a pulse check on world commerce and tech demand, as investors look for signs of a respite in the global economic slowdown.

Thailand’s GDP data, also out Monday, are expected to show a slowing of growth on a quarter-over-quarter basis.

The Bank of Korea and Bank Indonesia are seen holding rates on Thursday as inflation continues to weaken in both countries. Bloomberg Economics predicts a 200 basis-point rate cut by Sri Lanka’s central bank, which needs to beat back a surge in real rates caused by a precipitous decline in the inflation rate.

Tokyo CPI on Friday will show the likely direction of national prices in Japan as investors try to second-guess the Bank of Japan’s next move following last month’s tweak of its yield curve control program.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Latin America

Argentina’s Economy Minister Sergio Massa will be in Washington to meet the International Monetary Fund, whose board will vote Wednesday on a $7.5 billion disbursement to the country. That’s the same day June activity data are likely to show a decline, sealing a second-quarter GDP contraction.

Also on Wednesday, Peru output data are set to confirm that the economy is in recession.

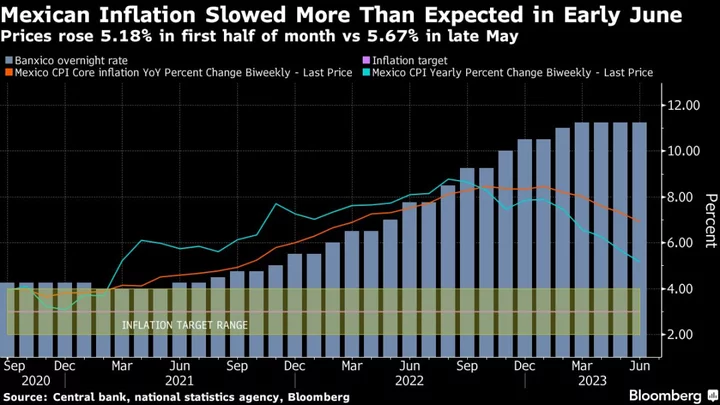

In Mexico, Thursday’s minutes from the August policy meeting are likely to reiterate that policymakers don’t anticipate more hikes and expect to hold the rate for a prolonged period.

On Friday, Brazil’s mid-August inflation print will shape market expectations on the central bank’s next policy move.

Beyond economic data, politics will be in focus across the region. Argentina is still grappling with the ramifications of Javier Milei’s surprise win in primary elections, with Ecuador and Guatemala holding presidential elections on Sunday.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Abeer Abu Omar, Laura Dhillon Kane, Paul Jackson, Reed Landberg, Matthew Malinowski and Monique Vanek.