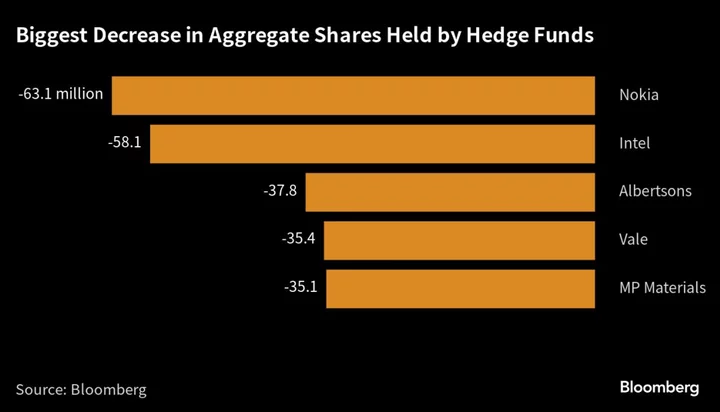

While hedge funds were busy chasing the technology rally in the second quarter, there was one stock that most firms could agree they wanted out of: Intel Corp.

More shares of the chipmaker were sold by the funds than any other company aside from mobile device maker Nokia Oyj, according to Bloomberg’s preliminary analysis of data from 13F filings. Steven Cohen’s Point72 Asset Management LP and David Tepper’s Appaloosa Management LP were among those that slashed positions.

“If everyone is selling a stock, that says something,” said Jim Awad, senior managing director at Clearstead Advisors. “I favor the tech industry, but there are better ways to play it than Intel.”

Intel has faced souring sentiment in the early stages of its turnaround plan, which hinges on reestablishing its once-bulletproof lead in chip technology. The termination of its $5.4 billion deal to acquire Tower Semiconductor Ltd. will be seen as a further setback, given it was once the keystone of Chief Executive Officer Pat Gelsinger’s plan to get into a faster-growing part of the industry, the foundry market dominated by Taiwan Semiconductor Manufacturing Co.

Shares of Intel fell 0.6% on Wednesday. The Philadelphia Stock Exchange Semiconductor Index fell 0.1%.

The company has struggled to plant its flag in artificial intelligence computing, the subject of obsession for traders this year and currently dominated by rival Nvidia Corp. That stock saw hedge fund bets rise by $11.4 billion in the second quarter while Advanced Micro Devices Inc. saw a $1.5 billion increase, according to the 13F data. Funds cut their Intel stakes by nearly half, with sellers outnumbering buyers two to one.

Intel offered signs of progress in its turnaround effort last month when it revealed a surprise profit in the second quarter and promised to show more evidence of its long-awaited comeback in the second half of the year. So far this quarter, the stock’s 3.2% gain is the third-best performance in the Philadelphia semiconductor index.

In the context of the full year, however, the stock still lags far behind other chipmakers. The longer Intel’s turnaround takes, the more inclined investors will be to look elsewhere, according to Clearstead’s Awad.

“It is trying to come up with more competitive products, but that will take time,” said Awad. “In the meantime there are better positioned companies.”

This story was produced with the assistance of Bloomberg Automation.

Tech Chart of the Day

As the rally in technology stocks cools in August, the Nasdaq 100 Index is inching closer to the lower-end of this year’s uptrend channel. The benchmark, which had risen for five consecutive months through July, is on track for its worst month of the year. The index is down about 4.8%, testing its 50-day moving average.

Top Tech Stories

- Intel said it’s walking away from its attempt to acquire Tower Semiconductor Ltd., abandoning a $5.4 billion deal after failing to win regulatory approval in time.

- Tesla Inc. made its second round of price cuts in China this week, further fueling concerns the carmaker is reigniting a price war.

- Apple Inc.’s next-generation iPhone 15 is beginning production in Tamil Nadu, in an effort to further narrow the gap between its India operations and main manufacturing base in China.

- Tencent Holdings Ltd.’s revenue missed estimates, signaling an uneven recovery for the world’s biggest internet arena as it grapples with rising Chinese economic turbulence and anemic consumer sentiment.

- Sea Ltd.’s historic 29% tumble erased close to $10 billion from its market value, wiping out a quarter of co-founder Forrest Li’s fortune overnight while darkening the shopping and gaming leader’s prospects.

Earnings Due Wednesday

- Premarket

- JD.com

- OneConnect

- Postmarket

- Cisco Systems

- Synopsys

- Wolfspeed

- Avnet

--With assistance from Ian King, Subrat Patnaik and Michael Msika.

(Updates to market open.)