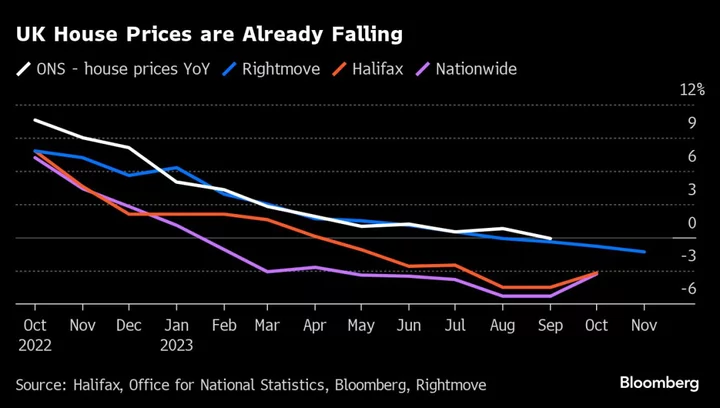

Falling house prices could worsen the crunch facing households when they come to refinance their fixed-rate mortgage deals, according to research from the Bank of England.

A 10% slide in house prices would push almost 700,000 mortgage holders into negative equity with a home worth less than the loan used to buy it, according to a report on the BOE’s Underground blog. It would also cause a further 350,000 recent mortgagors to be nudged into higher loan-to-value brackets.

Combined with a normalization in mortgage spreads — or the more expensive rates charged to customers in higher LTV brackets — from their current narrow levels, those 350,000 homeowners would see an average increase in their annual repayments of more than £2,000 ($2,507.3) when they refinance. That’s over and above the increase they are already set to see from generally rising interest rates.

“This could have a material impact on the economy,” wrote Fergus Cumming, deputy chief economist at the Foreign, Commonwealth and Development Office, and Danny Walker, chief of staff in the BOE deputy governor’s office.

Higher LTV mortgages carry higher interest rates than their lower LTV counterparts to reflect the increased riskiness of the loan. The spread between them has been tight since 2021 due to competition in the mortgage market. However, Cumming and Walker think it’s “plausible” that the spread on 90% LTV mortgages will increase by 100 basis points, and several economists have already penciled in a peak-to-trough fall in house prices of 10%.

This scenario would be far less severe than that seen in the aftermath of the 2008 financial crisis, where the 90% LTV spread — measured against 60% — reached over 250 basis points and house prices fell by almost 20% peak to trough.

But the effect will still be incredibly painful for mortgage holders whose rates have already jumped due to the higher BOE base rate.

Around a quarter of recent mortgages, taking into account principal repayments and house price growth since the loan was agreed, are currently at an LTV above 75%. That’s just under 800,000 mortgages.

But a 20% house price fall would push another 350,000 into that bracket, while elbowing 3% of recent mortgages into negative equity, meaning homeowners can become unable to sell or switch deals.

“At first glance, the impact of this scenario looks relatively modest in comparison to the increase in Bank Rate that has already occurred,” said Cumming and Walker. “But it is also true that the mortgagors impacted by this scenario are some of the most financially constrained households, and some of the most important for policymakers to consider.”