Codelco’s plunging production has deprived the global market of copper and Chilean state coffers of much needed revenue. Now the ripples are reaching bondholders.

The state-owned behemoth this week handed bondholders the biggest losses among emerging-market materials companies with investment grades. Codelco notes lost 3.3%, triple the peer-group average in that span.

Read More: Green Energy Transition Has a Chile Copper Problem

Dollar debt issued by the world’s biggest copper supplier has underperformed since late last Friday, when the company lowered its annual production guidance and raised cost estimates following another disappointing quarter at its mines in Chile.

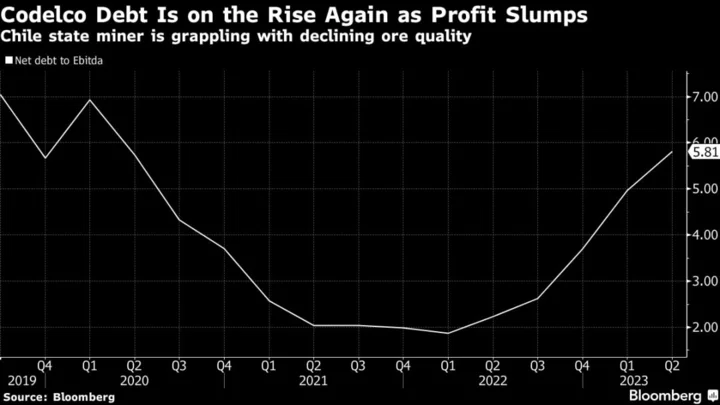

Its debt levels have now jumped to more than five times earnings before items, making it one of the most leveraged major copper producers.

Codelco’s output has sunk to the lowest in a quarter century as part of an industry-wide battle against falling ore quality. The state miner is facing a much bigger challenge than most of its peers though as it plays catchup after years of under-investment.

As a result, it’s having to juggle several big projects at a time of lingering supply chain disruptions, inflation and construction bottlenecks.

“The ability to fund and execute on projects remains a question,” BMO Capital Markets analyst Colin Hamilton said in an emailed note this week.

--With assistance from Sebastian Boyd and Valentina Fuentes.

(Adds production chart)