Former Bridgewater Associates LP executive Bob Elliott is expanding his firm’s ETF lineup with a variety of hedge fund-like strategies.

Elliott’s Unlimited, which focuses on alternative investments, is planning to launch eight exchange-traded funds that aim to replicate the returns of styles such as equity long-short, global macro and low beta, according to regulatory filings. The goal is to offer individual investors access to more sophisticated strategies at a lower cost relative to fees charged by private funds.

The executive, who spent over a decade at Ray Dalio’s investment firm, last year launched the nearly $40 million Unlimited HFND Multi-Strategy Return Tracker ETF (ticker HFND) — which focuses on a number of styles using machine learning.

Elliott declined to comment on the new funds, citing a regulatory quiet period.

Each fund will invest primarily in ETFs and futures contracts. Unlimited will determine the returns of the various hedge fund sectors, and use an algorithm that utilizes historical returns and positioning data to build ETF portfolios that best match each sector’s returns, according to the filing.

Shana Sissel, president of Banrion Capital Management, said she’s encouraged that Elliott’s fund lineup is bringing retail investors strategies that can provide better diversification.

“I’m very encouraged at his initial success,” she said, “But I’m concerned because this is a space where retail investors performance chase, and quickly things can turn.”

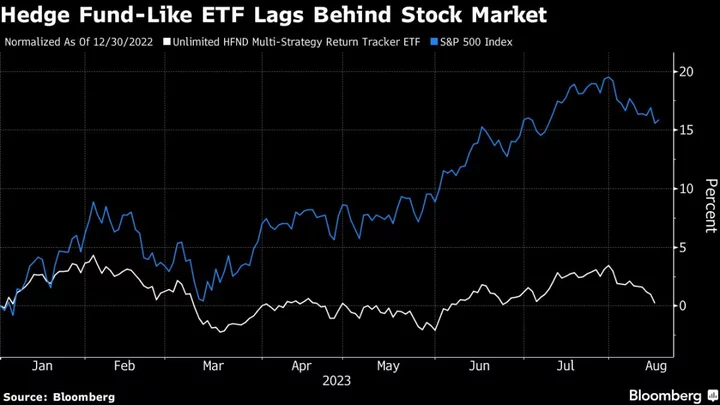

Indeed, the new funds come during a year when many hedge funds have underperformed stock and bond markets.

Hedge-fund veteran George Noble is shuttering his long-short equity ETF that has plunged more than 50% since its September debut. The Noble Absolute Return ETF (ticker NOPE) held positions against a number of tech stocks that have posted staggering advances in 2023.

Meantime, HFND is up only 0.2% this year, compared with a 16% advance in the S&P 500.

“While the underlying technology has worked largely consistent with our expectations, hedge funds have not performed as well as index funds over the last nine months because they have been positioned more conservatively,” said Elliott. “As a result, advisors who see the promise of the fund over time have been slower to make allocations until there is more evidence of differentiated performance.”