The UK economy lost jobs again in the quarter though August, marking the longest drop in employment since the depths of the coronavirus pandemic and a sign that inflationary pressures may be abating.

Employment fell 82,000 in June to August after a 133,000 drop in the period from May through July, the Office for National Statistics said Tuesday. It was third consecutive three-month period in which employment has fallen compared to the previous three months, the worst stretch since early 2021.

The ONS changed the way it calculates the figures released Tuesday after already delaying today’s unemployment and employment figures “to produce the best possible estimates.”

The new calculations indicate that the labor market may be slightly tighter than the ONS’s previous data had suggested. The revised 133,000 fall in employment in May to July under the new methodology was smaller than the 207,000 drop under the old estimates.

The broader picture shows the labor market is loosening, reducing the upward pressure on wages that concerned the Bank of England. The central bank in September halted a string of aggressive interest-rate increases designed to cool the economy and expects unemployment will rise as a result.

The pound edged up against the dollar after the release. It traded 0.2% stronger at $1.2277, rising for a fourth straight day to touch an almost two-week high.

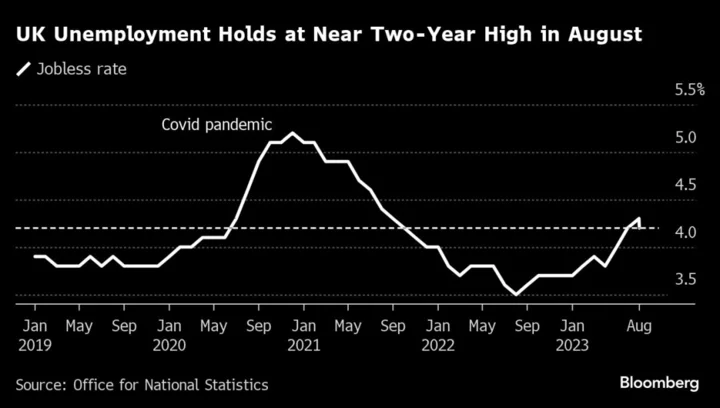

Unemployment held at 4.2% under the new calculation, lower than the 4.3% figure that the ONS previously released. That’s the highest in almost two years and up from as little as 3.5% a year ago when companies were hiring rapidly after the end of Covid-19 lockdowns.

Economists have increasingly raised questions over signals from the Labour Force Survey, which has been hit by a collapse in response rates from those surveyed and overwhelmingly samples older Britons.

“The data on the economy is still ambiguous,” said Neil Birrell, chief investment officer at Premier Miton Investors. “It’s hard to believe that sticky inflation and higher interest rates won’t have more impact on the surprisingly robust economy. Focus is now all on the upcoming round of central bank policy decisions.”

The new experimental data on employment and unemployment released on Tuesday is being compared with older figures using the previous methodology. Economists have raised questions about signals coming from the report, which has shown both a drop in vacancies and job creation along with strong wage growth.

“This new metric shows that in the latest period the employment rate was down a little, with small rises in the rates for both unemployment and those neither working nor looking for work,” said Darren Morgan, director of economic statistics at the ONS. “This is part of our transformation of the way we measure the labor market where we are introducing an improved Labour Force Survey, asking more people in different ways about their employment status.”

The figures feed into debate at the Bank of England on whether a further tightening in monetary policy is needed to rein in inflation, which remains more than triple the 2% target. The central bank halted its interest rate hiking cycle last month amid concern the sharpest series of increases in three decades may push the economy into a recession.

BOE policy makers led by Governor Andrew Bailey meet again next week to decide on interest rates. They’ve said ONS readings on wage growth were “difficult to reconcile with other indicators of pay growth.”

Britian lost at least 500,000 people from the workforce during the pandemic, prompting companies to bid up wages to secure the staff they needed to grow and feeding inflationary pressures. While many of those workers have now returned, companies complain they have difficulty finding people with skills to do the jobs they have open.

Prime Minister Rishi Sunak’s government has been focused on pushing more people into work and tightening rules on who can claim benefits. The aim is to reduce the level of inactivity — people out of work and not looking for jobs.

Some economists are now concerned that the rise in unemployment threatens to tip an already stagnant economy into recession.

The central bank expects the jobless rate to rise to almost 5% by the third quarter of 2026 as rate increases slow demand in the economy and curtail inflationary forces. That’s well above the near 50-year low of 3.5% reached a year ago, but it’s still below the 6.4% unemployment rate in the eurozone.

--With assistance from Irina Anghel, David Goodman and Constantine Courcoulas.

(Updates with comment, market reaction and detail from the report.)