Euro-area finance ministers are increasingly concerned about political radicalization as a shaky economic outlook and sticky inflation leave voters looking for different options.

France’s Bruno Le Maire warned of the risk of extremist parties gaining ground in Europe, fueled by the cost-of-living crisis. That was echoed by other participants at a two-day meeting of finance chiefs in western Spain, attended by European Central Bank President Christine Lagarde, said people familiar with the matter.

German Finance Minister Christian Lindner was among those voicing concern about far-right forces gaining momentum, one of the people said. The outlook for Germany, the largest euro-area economy, has deteriorated against the backdrop of weak performance in China, a shortage of skilled workers, and domestic demand depressed by inflation. At the same time, support for the right-wing Alternative for Deutschland party has been rising.

The ministers’ discussion came on the heels of the ECB’s 10th consecutive interest rate hike on Thursday. Lagarde on Friday reiterated her institution’s pledge to keep rates at “sufficiently restrictive levels” as long as needed for inflation to return to the ECB’s 2% goal.

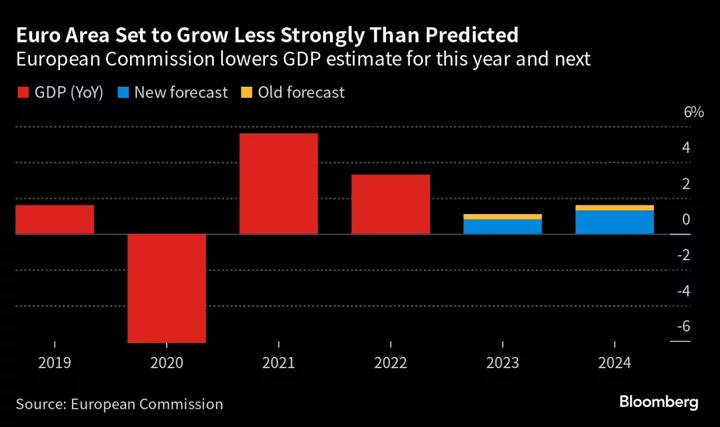

The European Commission, the EU’s executive arm, lowered its forecast for euro-area growth in 2023 and 2024 this week. The government in Berlin is preparing to cut its economic outlook for this year to reflect a contraction instead of modest growth, according to people familiar with the revised forecast.

Read more: German Inflation Trauma of 1923 Strikes an Uneasy Chord Today

The chair of the European Parliament’s Economic and Monetary Affairs Committee, Irene Tinagli, warned at the meeting in Santiago de Compostela that if the region’s economy deteriorates more than predicted, “we could also face political consequences and a radicalization of the political debate.”

She added that the EU elections next June make the polarization of the political arena more likely.

The impact of the ECB’s rate decisions on savers was also raised during the discussion, the people said. Dutch Finance Minister Sigrid Kaag said citizens are starting to raise questions about huge profits being reeled in by banks from higher interest rates, which haven’t been fully reflected in savings rates offered to consumers, the people added.

EU institutions and member states are concerned about how businesses and households have absorbed repeated body-blows from crises including the Covid pandemic and the energy crunch triggered by Russia’s invasion of Ukraine. Governments are also worried about the loss of competitiveness of the European economy compared with US or Chinese firms.

Still, some point out the resilience of Europe’s labor market in spite of low economic growth, with unemployment in the euro area around 6%, will be critical in keeping voters’ support this year and next.

--With assistance from Alessandra Migliaccio, Alonso Soto, Jana Randow and William Horobin.