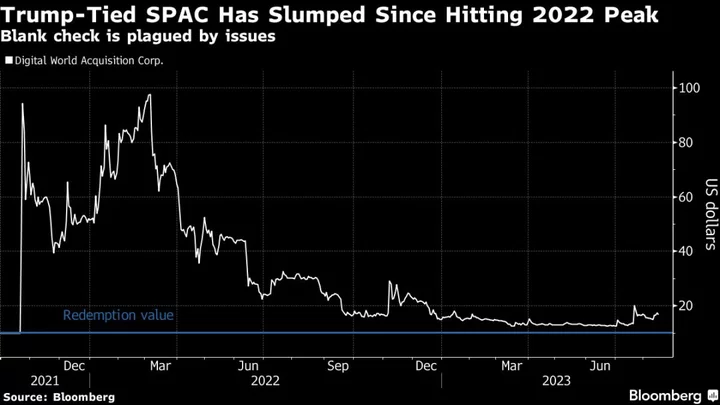

The blank-check company seeking to take Donald Trump’s media company public sweetened the proposed deal to keep the former president from walking away. Now it needs to make sure rank—and-file investors stick around, too.

Digital World Acquisition Corp., the special-purpose acquisition company that’s been waiting to take over Trump Media & Technology Group for nearly two years, will ask investors on Thursday to push out the deadline for closing the deal by another 12 months. The blank check said in a filing Wednesday evening that the meeting will be held on Sept. 5 and not Aug. 17 as originally scheduled.

That would be the fifth such extension and potentially give it the time needed to surmount the remaining legal hurdles to buying Trump’s company, whose main asset is Truth Social, the Twitter look-a-like he uses to communicate with followers. Shares slipped 3.1% in trading after Wednesday’s close as the delayed-vote filing circulated.

As it stands, the SPAC must complete a deal by Sept. 8 or risk returning its roughly $300 million to investors. Such an unwinding would be costly to stockholders: The SPAC shares are trading for some 60% more than the $10.24 investors will get back if the merger collapses.

The high premium reflects the rally since last month on optimism the deal will finally get done after Digital World reached a settlement with the Securities and Exchange Commission and revamped the structure of the deal to help ensure Trump stays committed to it. The changes included those that would benefit Trump himself, including the creation of a new class of shares to be issued to the company’s principal.

“With Trump involved you would expect controversy and all sorts of twists and turns, so DWAC has not disappointed,” said Matthew Tuttle, chief executive of Tuttle Capital Management. He’s never seen a SPAC dole out super-voting shares this late in the game, but said that “it’s Trump, so expect the unexpected.”

Read more: Trump-Tied SPAC Climbs as Merger Partners Extend Pact Timing (1)

Yet the SPAC closing remains far from certain. The reworked deal allows Trump Media to walk away by Sept. 30 if its board decides the merger isn’t in investors’ best interest or by Oct. 13 if Digital World doesn’t file an amended registration statement by Oct. 9. Digital World also has similar powers to break it off.

Another pressing issue for Digital World: in May it said it will need to restate its 2022 financial results after accounting errors were discovered. It’s former auditor, Marcum LLP resigned, citing the SEC charges. The SPAC, which has since hired Adeptus Partners LLC, was also warned by Nasdaq that its shares could be delisted for delays in filing its financial reports.

The delayed vote follows a trend that dogged Digital World last year when the SPAC had to postpone the vote a handful of times as it hounded the individual-investor crowd to approve the proposals.

But for the SPAC’s shareholders, Trump Media’s commitment to the deal until the end of the year was a strongly positive move forward, said Usha Rodrigues, a professor of corporate law at the University of Georgia School of Law.

“However, the SPAC will still need to get investor buy in to extend the SPAC,” she said, “which isn’t guaranteed.”

(Updates with delayed shareholder detail throughout.)