Good morning from London, where it looks like the country has once again managed to dodge a policy-induced recession, for the time being at least. The UK economy flatlined in the third quarter and managed to eke out 0.2% growth in September, the latest stats show.

For corporates, the mood is slightly less optimistic though, especially for drinks giant Diageo. It lowered first-half guidance on weaker prospects in Latin America and Caribbean, a region that contributes more than 10% of its sales, sending the shares plunging.

What’s your take? Ping me on X or drop me an email at gmello4@bloomberg.net.

Key Business News

Diageo Plc now sees organic net sales in Latin America and the Caribbean dropping more than 20% in the first half of fiscal 2024. Shares of the Johnnie Walker and Guinness maker slumped more than 10% at the open.

Chemring Group Plc is turning its back on the explosive hazard detection business in the US. The company will focus on biological detection and security markets after conducting a strategic review of its US Sensors business. That offers the best way to maintain strong margins and deliver growth, it said.

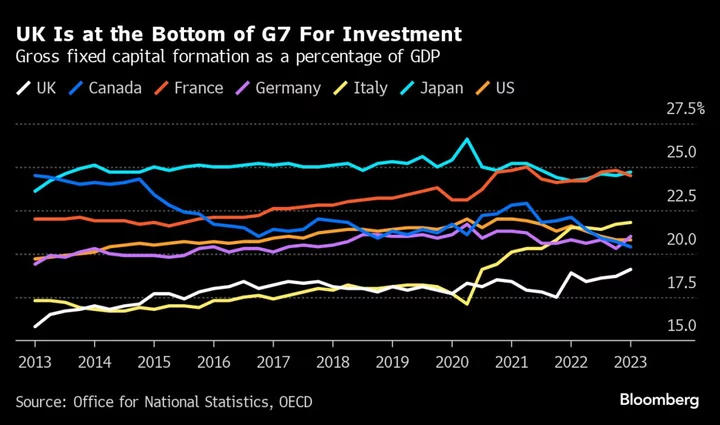

Eco News: The UK economy flatlined in the third quarter, reducing the risk of a 2023 recession but suggesting Britain is facing a protracted period of stagnation as higher interest rates take their toll. Gross domestic product was unchanged from the second quarter, the Office for National Statistics said Friday. Economists surveyed by Bloomberg had forecast a 0.1% decline on average. In September alone, GDP rose 0.2%.

Markets Today’s Take

It looks like the UK isn't yet in a recession and could avoid one this year. Things like warmer weather in September helped construction activity, while the dominant services industry appears to be holding up slightly better than feared. The Markets Today team is looking at the report with a dose of realism, though. Things may be better than feared but activity is still not that great. As Dave points out, it's hard too get excited about zero growth in the third quarter because it's not that much better than the 0.1% contraction expected by economists. Nothing is final yet either: there are potential revisions to consider, with today's report showing only the preliminary figures.

While the UK may dodge the risk of recession, the risk of stagflation -- a scary word meaning a flatlining economy that's grappling with high rates of inflation at the same time -- hasn't gone away. The UK economy is still struggling to grow and that's likely to be the case for some time. Just have a look at the pound: it rose briefly after the report only to give back most of those gains minutes later.

— Sofia Horta e Costa

For more news and analysis throughout the day, follow Bloomberg UK’s Markets Today blog.

City Moves

PrimaryBid tapped former Winterflood executive Stacey Parsons to be its fixed-income head. Investec hired Eaton Partners’ Stefano Manna to run its new GP Advisory team, while former Credit Suisse dealmaker Christian Brucher will be overseeing Nomura Greentech’s transport coverage in EMEA. Catherine Newman, who has been CEO of Limejump and oversaw LNG trading operations at Shell, joined CFP Energy as chief operating officer. And the Bank of England named Nathanaël Benjamin as its new executive director for financial stability, strategy and risk.

What’s Next?

Heathrow Airport Holdings Ltd. is set to disclose October traffic figures early next week. That’s after it raised its 2023 guidance, citing the return of Asian trips and business travel almost back to pre-pandemic level. Defense giant BAE Systems Plc will also update on Monday morning.

--With assistance from Leonard Kehnscherper.