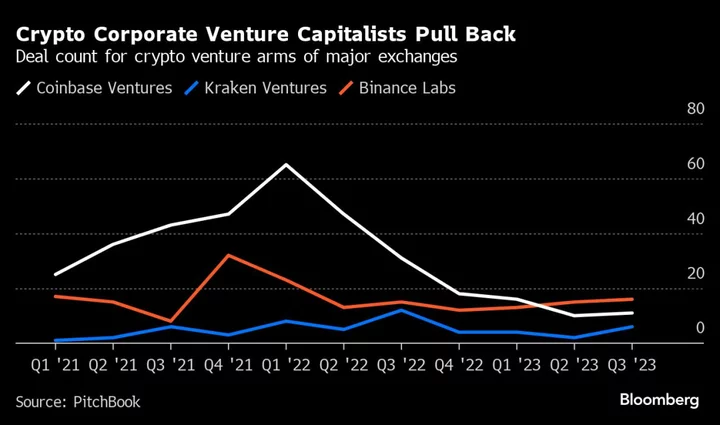

Coinbase Global Inc. is one of the most important investors in the world of cryptocurrency. It’s the all-time biggest backer of industry startups in terms of number of deals, according to PitchBook data. But in recent months, its investing activity has fallen off.

The decline is part of a larger pullback from investing at crypto companies — which often have substantial venture capital arms. While overall crypto venture funding tumbled 63% to $2 billion in the third quarter compared to the same period last year, many corporate VC businesses cut back even more rapidly, said PitchBook crypto analyst Robert Le.

The decline, coupled with a larger shift toward making smaller bets, indicates “a more cautious approach” from corporate investors, Le said, citing an industry-wide desire to conserve cash. “In this environment, they want to focus on their core business,” he said.

As for the capital Coinbase is still investing, it’s changed tack. Coinbase Ventures, the company’s venture arm, is backing more startups based outside of the US as regulatory scrutiny of the crypto industry increases, said Hoolie Tejwani, director of corporate development and ventures.

“We are seeing some companies and founders who have great ideas, and they’re saying, ‘OK, I need to extract the US from my business plan and not serve US customers,’ which is a shame,” he said.

Despite the slowdown, Tejwani said his team is actively deploying capital and has made more than 50 investments across 15 countries in the past year. While American startups are facing greater headwinds, the company sees potential for growth in India, Singapore, Australia and the UK.

Keeping Pace

Other major crypto companies are also reevaluating their strategies. At Kraken Ventures, the venture arm of crypto exchange Kraken, managing partner Brandon Gath said the division’s deal count had declined over the past year — but his team is still actively making investments.

“Over the last two years, we typically do about three to four new deals a quarter and deploy about $3 million in capital,” Gath said, adding that Kraken Ventures was also meeting that pace in the third quarter of this year.

Kraken Ventures is still in the process of raising a new $100 million fund and is continuing to invest outside of the crypto industry, Gath said. About 40% of Kraken Ventures’ startups are based in the US, 40% in Europe and 20% in the rest of the world. The group invested in a non-crypto startup called Pinwheel last year. But Gath noted that even though the company primarily provides payroll services, it could also help the crypto industry by making it easier for employees to get paid in digital currencies like stablecoins.

Kraken’s view of the startup world is mixed. The valuations for very young startups haven’t declined as dramatically, Gath said, adding that he often sees pre-money valuations at about $10 million to $30 million for early-stage companies. But at the later stage, both crypto and tech companies more broadly have seen valuations drop 30% to 50%.

“These companies raised valuations that were probably a little bit too high,” he said.

Lessons Learned

Binance Labs, the venture arm of Binance Holdings Ltd., the world’s biggest crypto exchange by trading volume, also makes crypto investments. So far, the company says it’s not changing its strategy.

“We are more proactively looking for founders,” said Dana Hou, who oversees business strategy and operations for the division. “It’s easier to find builders who are more committed to the industry.”

Binance has faced major regulatory setbacks in the US, including legal action that severely crippled its American affiliate, Binance.US, and caused many employees to rapidly exit the country. But the venture arm, which has $9 billion in assets under management according to reports, has continued to invest in more crypto projects, including those based in the US, Hou said.

She said that recent layoffs at Binance have not affected Binance Labs, noting that the team is “stable” and has all of its members listed on the company’s website. An analysis of the team members listed on the Binance website shows that Binance Labs has lost 10 of its team members since January, shrinking from 18 people to eight.

“Binance Labs continues to hire, and we have welcomed new members to the team,” the company said in a statement to Bloomberg when asked about the departures.

Binance, which invested in bankrupt crypto exchange FTX, is also committed to properly vetting the projects it invests in, Hou said. Venture capitalists came under fire after FTX’s collapse, with critics arguing that their firms did not conduct enough due diligence on the company.

Hou said she was not working at Binance when it invested in FTX, but that the company has learned its lesson from the startup’s spectacular downfall, and has stepped up its monitoring of portfolio companies and their founding teams.

“It’s so important to identify who the founder really is,” she said.

Binance Labs and other venture investors are now more focused on backing startups that already have real products and revenue, instead of just positive buzz, Hou said. “In the past, a project gets very hyped, just because that project got invested by a VC,” she said. More recently in the crypto industry, hype is less of a concern.