Unprecedented price swings this week in the bonds of one of China’s most closely watched property firms, after it gave shifting messages to investors, are fueling broader governance concerns in the nation’s junk note market.

Dalian Wanda Group Co.’s “corporate governance has taken a battering as a result of the flip-flopping,” said Charles Macgregor, head of Asia at Lucror Analytics. The comment followed some creditors of the Chinese conglomerate first being told of uncertainty it could meet repayment of a $400 million note maturing July 23, then that repayment chances had turned relatively high.

Corporate-governance concerns in China’s property sector have been raised by numerous analysts and investors, with S&P Global Ratings lowering a governance score for a key Wanda unit to weak on Thursday to reflect inadequate risk management. Firms including GLP Pte and Greenland Holdings Corp. have previously been flagged by some about their governance.

Wanda Group didn’t immediately offer a comment when reached Friday. In a statement to the Shanghai exchange responding to this week’s credit-rating downgrades by S&P Global Ratings and Moody’s Investors Service, unit Dalian Wanda Commercial Management Group Co. said its operations remain stable and the profitability outlook is good.

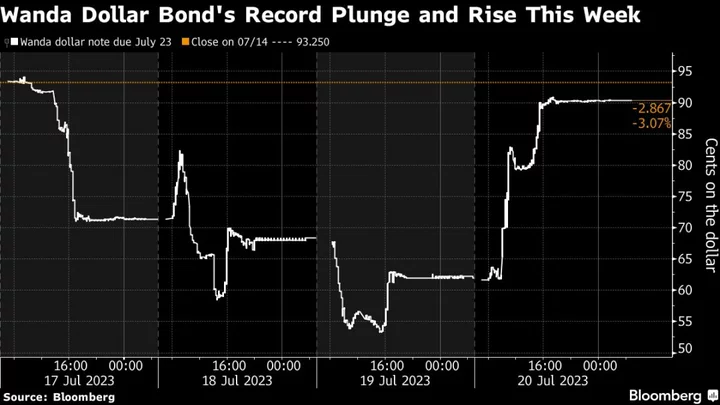

This week’s focus regarding Wanda has centered on a dollar bond that’s due July 23. The note logged a record daily plunge on Monday as Wanda Commercial told some investors that there was a funding gap of at least $200 million for repaying the bond. It then had its biggest-ever gain Thursday as some creditors were told an asset sale was being finalized and repayment chances had brightened significantly.

The wild ride has left the note down just 5 cents for the week at 88 cents, after bottoming at 53 cents on Wednesday.

Lucror’s Macgregor said Wanda’s asset-disposal efforts, which prompted Thursday’s rally, left “a sour taste in investors’ mouths given the group had recently denied having sufficient funds, resulting in a collapse in bond prices.”

Even if on-time payment is made, plenty of worries persist.

Prices for the three other dollar bonds issued by Wanda units are between 28 cents and 37 cents. Meanwhile, S&P and Moody’s both dropped Wanda Commercial out of single-B territory on Thursday and kept them on watch for further downgrade because of liquidity concerns.

--With assistance from Emma Dong.