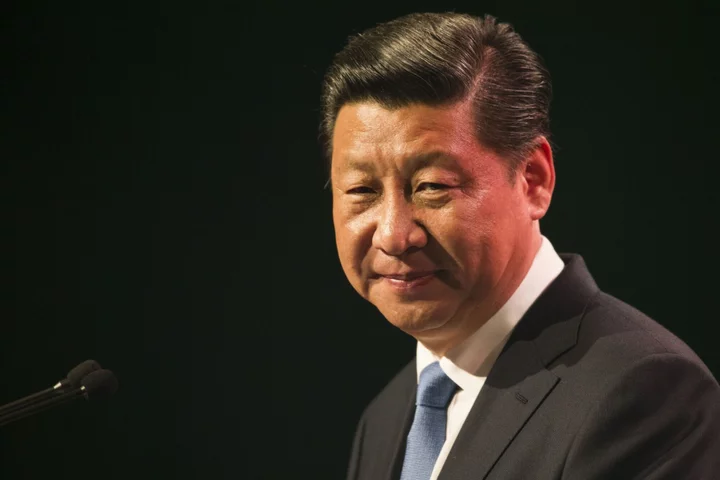

China’s monetary and fiscal stimulus measures will only go so far to lift its stock market, with structural reforms necessary for a long-term boost, according to Allianz Global Investors.

“It’s a confidence issue,” Raymond Chan, the firm’s equity chief investment officer for the Asia Pacific, said in an interview. Reforms to China’s heavyweight property sector and listed companies overall are needed to restore consumer and corporate faith in spending and investing, he added.

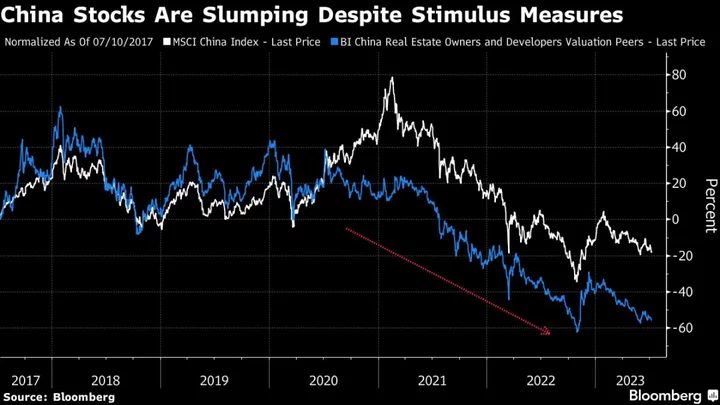

The selloff in Chinese assets deepened this month as worries mount about the economy amid continued concern over the property sector, which contributes about a fifth of the nation’s growth and the bulk of its household wealth. The MSCI China Index has fallen more than 20% from a January high into a bear market, as gains from support measures have proved short-lived.

AllianzGI, which manages about $560 billion globally, has held an underweight position on mainland China and Hong Kong equities in regional mandates and funds this year. The Allianz China Equity fund is down 21% over the past year, beating 67% of peers, according to data compiled by Bloomberg.

Hong Kong-based Chan said the firm is waiting for reforms and more supportive measures before increasing exposure to Chinese real estate and consumer stocks.

Curbing property supply after ensuring that stalled projects have been completed would help stabilize prices, he said. The government could also tweak its rhetoric aimed at dissuading property speculation to promote more investing, making it a viable asset class, added Chan, who has managed Asian equity investments for the past three decades.

Among possible steps to support the overall market, authorities could push companies to increase returns on equity, similar to the Tokyo Stock Exchange’s directive earlier this year asking firms to improve their valuations, Chan said. The MSCI Japan Index is up 20% in 2023, with the bourse’s efforts seen as a major contributor to the gains.

“If the message is clear,” good companies will undertake efforts to improve ROE and valuations, he said. “That’s the only way for the market to perform.”