Australia needs to tighten monetary policy further as part of stepped up efforts to rein in inflation that include governments slowing the pace of public investment, the International Monetary Fund said in a staff report.

While inflation has come off a peak, it remains well above the central bank’s 2-3% target and broader economic growth is still proving resilient in the face of 4 percentage points of hikes since May 2022, the fund said Wednesday in the concluding statement of an Article IV mission.

“Staff therefore recommend further monetary policy tightening to ensure that inflation comes back to the target range by 2025 and minimize the risk of de-anchoring inflation expectations,” it said. “Continued coordination between monetary and fiscal policy is key to securing more equitable burden sharing.”

The IMF called on federal, state and territory governments to implement investment projects at a “more measured and coordinated” pace. “Otherwise, interest rates would have to be even higher, putting the burden of adjustment disproportionately on mortgage holders.”

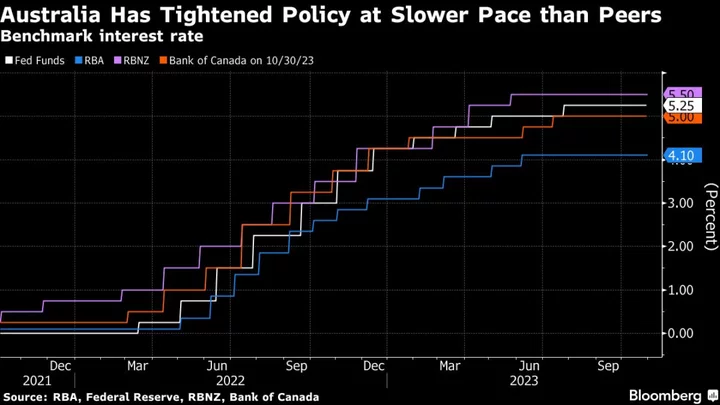

The report comes just under a week before the RBA’s policy meeting on Nov. 7, when it is expected to hike by 25-basis-points to take the cash rate to a 12-year high of 4.35%. The RBA has moved at a more cautious pace than global counterparts in the current cycle, with one reason being the nation’s household debt of 186.7% of income — among the highest in the developed world.

The RBA has also cited long and variable lags to monetary policy and the prevalence of floating-rate mortgages in Australia among reasons for its cautious stance. The IMF said authorities need to step up their efforts.

“Staff assess that more is needed to bring inflation back to target and keep inflation expectations anchored,” the report said. “Continued coordination between fiscal and monetary policy is key to achieving a soft landing, while alleviating the impact of policy tightening on vulnerable households.”

Australian households, on average, are proving resilient to higher borrowing costs with data this week showing retail sales jumped 0.9% in September, triple economists’ forecasts. The jobs market is still tight with unemployment hovering in a 3.4-3.7% range since June last year.