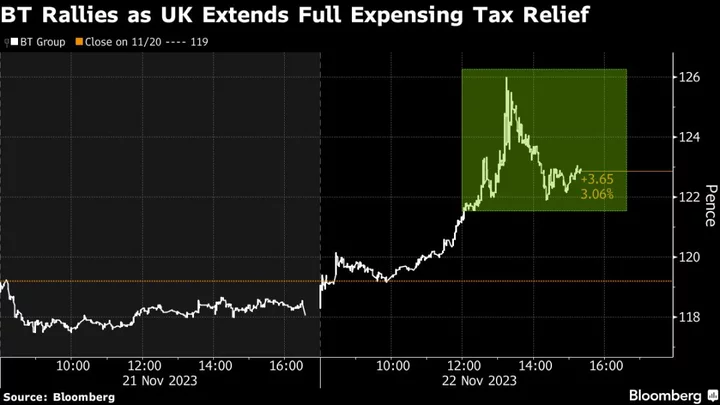

Shares in BT Group Plc rose as a cut to taxes on investments announced by UK Chancellor of the Exchequer Jeremy Hunt was expected to benefit the company that’s spending billions of pounds building high-speed internet infrastructure.

The stock gained as much as 6.7% before closing up 3.7% after Hunt said in his Autumn Statement that the country’s “full expensing” regime — a tax break for businesses which invest — will be made permanent.

Hunt’s move is an attempt to turbo-charge business investment in the UK, which has fallen by more than 25% since 2016-17, according to government statistics. Investment as a percentage of output has lagged other Group of Seven nations.

The tax break, which was previously due to expire in 2026, could offer a major boost to BT, given its investments in broadband networks. The former state-owned telecommunications operator has pledged to invest £12 billion ($15 billion) to deliver ultrafast broadband to 25 million UK homes and businesses by December 2026.

“If we are to raise productivity, we need to increase business investments further,” Hunt said, referring to the measure as “the largest business tax cut in modern British history.”

Read More: Hunt Cuts Personal and Business Taxes in Bid to Lift UK Growth

The extension of full expensing could offer “a very material benefit” to BT, New Street Research analyst James Ratzer said in a note ahead of the Autumn Statement. The carrier could see a 30% rise in free cash flow between 2027 and 2032, he estimated.

Competition from smaller rivals has pushed BT to build fiber connections as quickly as possible, Ratzer said. The extended tax relief could take some pressure off the company’s network arm Openreach, reducing the need for it to front load investments.

The UK government has committed £5 billion to upgrading Britain’s broadband network, which lags speeds seen in some other major European countries.

In a blog post last week, BT’s outgoing CEO Philip Jansen called for the government to make full expensing permanent. The measure would be a “real game-changer” and would give the company long-term visibility to plan investments, he said.

The government said the tax cut would be worth more than £10 billion a year for UK businesses. The Office for Budget Responsibility forecasts that it will boost business investment by £3 billion a year.

Full expensing allows companies to write off the cost of certain equipment, such as IT systems and machinery. It equates to a tax deduction of as much as 25% of the cost of investments on qualifying equipment in the first year. The chancellor announced in the spring that the measure would last for three years, but it will now be made permanent, allowing companies to plan longer-term investments, Hunt said.

Full expensing does not currently include items that are leased instead of purchased outright, but the government said it will launch a consultation on whether to expand it.

The policy “will provide long term certainty for firms in making that permanent which will really help them in their long term investment decisions in the UK,” Louise Hellem, chief economist for the Confederation of British Industry, told Times Radio.

Investment Zones

The UK Treasury also announced two investment zones in Wales. One is in the area that includes Cardiff and Newport and the other covers Flintshire and Wrexham, the town whose football club is now owned by actors Ryan Reynolds and Rob McElhenney.

The government said it would reform Britain’s “outdated” planning system and would also reduce delays to major infrastructure projects getting access to the electricity grid.

It announced a simplification of research and development tax incentives and also lowered the threshold for loss-making startups to qualify for tax breaks from 40% to 30% when it comes to their percentage of spend on R&D.

--With assistance from Joe Easton.

(Updates with details on full expensing and other measures throughout.)