Bond traders are bracing for Treasury yields to keep pushing higher after the Federal Reserve signaled it’s likely to hold interest rates at lofty levels well into next year.

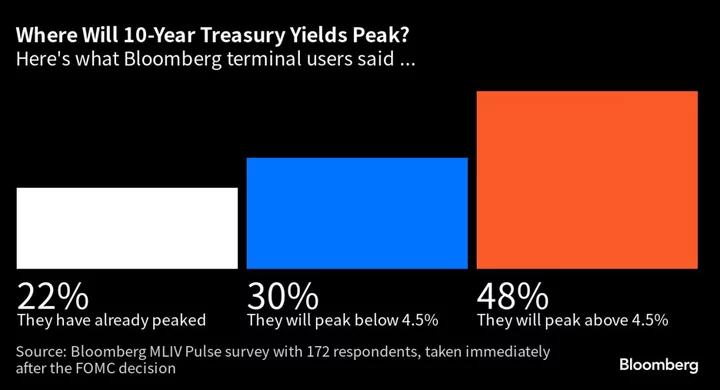

Fifty-eight percent of the 172 respondents in the Bloomberg Markets Live Pulse survey conducted after the Fed’s decision said that 2-year Treasury yields have yet to peak, while a plurality expect 10-year yields to climb over 4.5%. Two-year rates rose above 5.19% Thursday to a fresh 17-year high, while 30-year yields climbed to 4.48%, a level last seen in 2011.

While the central bank left its benchmark rate unchanged Wednesday, policymakers indicated they may tighten monetary policy once more this year and scaled back estimates for rate cuts in 2024.

“The hawkish tone means we should expect shorter term underperformance of bonds as the markets price out cuts in 2024/25, and weakness in risky assets as the market searches for the end to the policy cycle in the US,” said Kellie Wood, a fund manager at Schroders Plc in Sydney.

The Fed’s more aggressive outlook also spurred a selloff across other bond markets. New Zealand 10-year yields jumped to 5.17%, the highest since 2011, with the move enhanced by data showing the economy grew more than twice as much as economists expected in the second quarter. Similar-dated Australian yields touched 4.32%, near a nine-year high reached last month.

Hawkish Outlook

The updated forecasts underscore the central bank’s message that monetary policy is poised to remain tight as the surprisingly resilient economy leaves fighting inflation the predominant concern. As a result, traders keep pushing out the timing of when the Fed will shift gears, dashing hopes for the bond rally that would likely emerge once it starts cutting rates again.

The totality of recent data has the Fed “emboldened to keep rates higher for longer,” Diane Swonk, chief economist at KPMG, said on Bloomberg Television. “This is a different world than the one we left in 2019.”

The Fed’s break from the low interest-rate environment that had persisted since the 2008 credit-market crash has battered bond investors as prices drop, more than offsetting the income from higher interest payments. Treasuries are headed toward the third straight annual loss, with the market down 0.6% in 2023 through Tuesday, according to a Bloomberg index. It tumbled 12.5% in 2022, the worst rout since at least the early 1970s.

Traders have been repeatedly caught off-guard when attempting to call the market’s bottom. That’s largely because the economy has confounded forecasters by continuing to grow despite the Fed’s steepest rate hikes in four decades.

With inflation still stubbornly above the central bank’s 2% target, Fed policymakers’ median forecast was for the bank’s benchmark rate to be around 5.6% at the end 2023, and they raised the December 2024 estimate to around 5.1%. The rate is in a range of 5.25% to 5.5% now.

The majority of Pulse survey respondents, or 57%, said the Fed will keep raising rates, despite the latest pause. And since in prior cycles Treasury yields have tended to peak around the same level as the Fed’s benchmark, they may have room to rise further, as well.

Futures traders have also dialed back the amount of interest-rate cuts they foresee the US central bank doing next year. Traders now see the effective funds rate, after topping out near 5.5%, going on to end 2024 at about 4.75%.

Half of the survey’s respondents said they expect the Fed to keep its rate at the peak level until the second half of 2024, while a little over a quarter said it would keep it there until the second quarter.

“If the data continues to come in as we have seen recently, whereby job hiring softens slowly and inflation is sticky, you will see the timing of rate rate cuts being pushed further out,” Kevin Flanagan, head of fixed-income strategy at WisdomTree. “A reasonable case for now is that you see policy on hold for the better part of next year.”

The MLIV Pulse survey was conducted among Bloomberg terminal users within 90 minutes after the FOMC decision by Bloomberg’s Markets Live team, which also runs the MLIV blog. Sign up for future surveys here.

--With assistance from Georgina McKay and Garfield Reynolds.

(Updates yield levels in second paragraph, adds comment in fourth, yields climbing for New Zealand, Australia in fifth.)