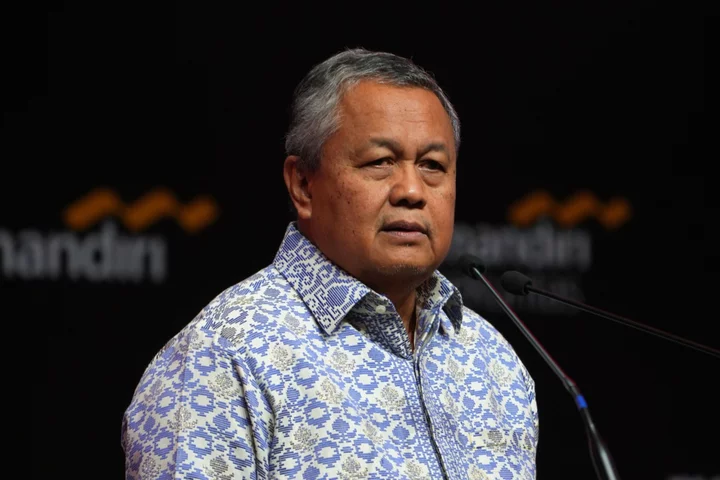

Indonesia’s central bank is set to keep interest rates steady to protect the rupiah from the global market selloffs, Governor Perry Warjiyo said.

Bank Indonesia will watch the Federal Reserve’s next move and the strength of the US dollar in assessing its next policy move, Warjiyo said in an interview with Bloomberg Television’s Francine Lacqua in London on Friday.

Indonesia’s rupiah has been among the biggest losers in Asia in the past month as a selloff swept through emerging market assets amid the threat of elevated interest rates in the US. Maintaining currency stability is Bank Indonesia’s main objective, and Warjiyo has cited the dollar’s strength as the reason why the authority has resisted cutting borrowing costs despite favorable inflation and economic conditions.

Even if Warjiyo and his colleagues in the monetary panel were to extend the rate pause at the Oct. 19 meeting, Indonesia risks reaching rate parity with the US, should the Federal Reserve decide to move by another quarter-point next month.

The rupiah dropped 3% last quarter and has erased year-to-date gains as the US dollar rallied further this week. Capital flight sent the yield on the benchmark 10-year note past 7%, a level last seen in November and one that had prompted the central bank to buy bonds in the market for the first time since 2022.

Bank Indonesia has kept its benchmark interest rate steady at four-year high of 5.75% since February as Warjiyo said that previous rate hikes have been sufficient in bringing inflation return to target, even earlier than expected.

The monetary authority has been using market tools instead to lure foreign inflows and defend the rupiah. However, the so-called rupiah securities SRBI and the FX term deposit for exporters haven’t yet delivered their intended results. On the domestic front, weaker exports and surging oil import costs could drag the current account into a wider deficit this year, weighing further on the rupiah.