The yen recovered from a seven-month low against the dollar as traders weighed a pull back in US yields against the expectation the Bank of Japan will keep policy unchanged Friday.

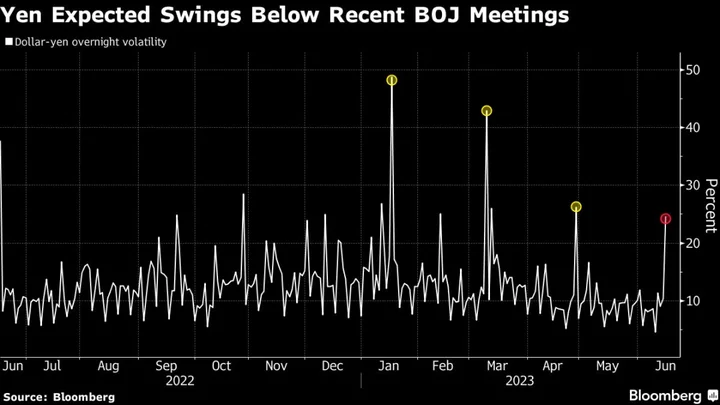

The Japanese currency strenghtened to the 140.20 per dollar level in early Tokyo trading, having weakened to 141.50 on Thursday. Overnight implied volatility in the yen, a gauge of expected swings, closed below levels seen before previous central bank meetings this year.

Treasury yields fell across the curve Thursday, a move which helped weaken the dollar and allow the yen some breathing space. But almost all of the economists surveyed by Bloomberg see the BOJ leaving its ultra loose policy unchanged Friday, something which may reignite the weakening pressure.

“We expect no change in monetary policy, and judge market participants expect no change, too,” Commonwealth Bank of Australia economist Joseph Capurso, wrote in a note. “Therefore, dollar-yen and Australian dollar-yen should not move much today.”

The yen has come under broad selling pressure recently, down against every G-10 peer so far in June, thanks to the stark contrast between a dovish BOJ and hawkish peers like the Federal Reserve and European Central Bank. It hit a 15-year low against the euro and surpassed last month’s lows against the greenback that led the nation’s top currency official Masato Kanda to say the government would take action if needed.

Last year, the yen weakening toward 146 per dollar triggered Japan’s first intervention to prop up the currency since 1998, though in the build up to that there were repeated official warnings about direct action. The Japanese currency has fallen more than 6% this year.

“The only reason to buy yen may be the intervention,” said Marito Ueda, general manager of market research department at SBI Liquidity Market Co. “The real level to spur the action may be above 145. The tone of verbal intervention remained the same so far and the real action is unlikely for the time being.”