The yen slid to its weakest against the dollar since November after Federal Reserve Chair Jerome Powell said officials expect interest rates need to move higher to curb inflation, highlighting diverging expectations for policy in Japan and the US.

The yen dropped as much as 0.6% to 142.36 per dollar before paring losses to trade around the 141.80 level in early Thursday trading in Tokyo. The Japanese currency has slid nearly 8% against the dollar this year, the second-worst performer among its developed-market peers.

It has fared even worse relative to other trading partners: The euro-yen cross has hit its highest since 2008, data compiled by Bloomberg show.

“Anything above 145.00 should make the yen shorts very concerned,” said Brad Bechtel, a foreign-exchange strategist at Jefferies. The decline in a trade-weighted gauge of the yen to the lowest in more than two decades may mean there will be “some fireworks on the horizon,” as officials are watching this measurement, he said.

Japanese officials, including Finance Minister Shunichi Suzuki, have warned they are watching the currency moves closely and ready to act if needed, as they did late last year. Powell’s hawkish comments on Wednesday underscored the Fed’s policy contrast with the Bank of Japan, where Governor Kazuo Ueda has repeatedly said he will patiently continue with monetary easing.

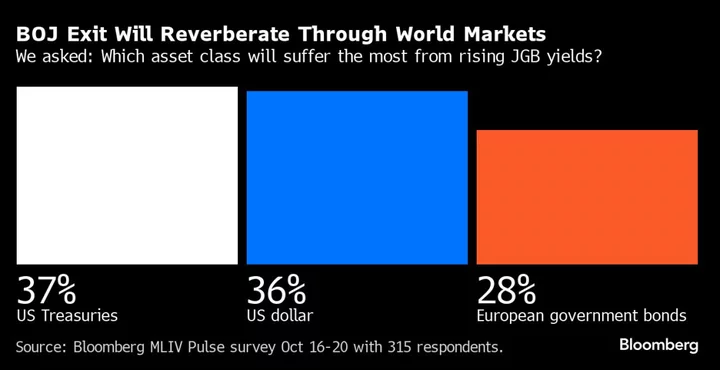

Still, one BOJ board member has hinted at the need to consider revising the yield-curve control program that’s kept Japanese yields well below those in the US and weighed on the currency. That helps support the view among some economists that the bank may adjust its policy framework next month, adding speculation over the next move.

Yen option turnover exceeded its major peers Wednesday, according to data collected by Depository Trust & Clearing Corp., with traders hedging potential gains in the Japanese currency after July.

The weak yen “will only be turned around by either a BOJ policy shift, or a turn lower in US yields,” wrote Societe Generale strategist Kit Juckes. “Our economists expect the BOJ will act in July on YCC and our rates strategists think a turn lower in US yields is close by too, but until that happens, frustration will remain.”

--With assistance from Robert Fullem and Mark Tannenbaum.

(Updates pricing, adds comment.)