Thailand’s baht may be poised for a rebound as analysts bet that growth measures announced by newly appointed Prime Minister Srettha Thavisin will bear fruit.

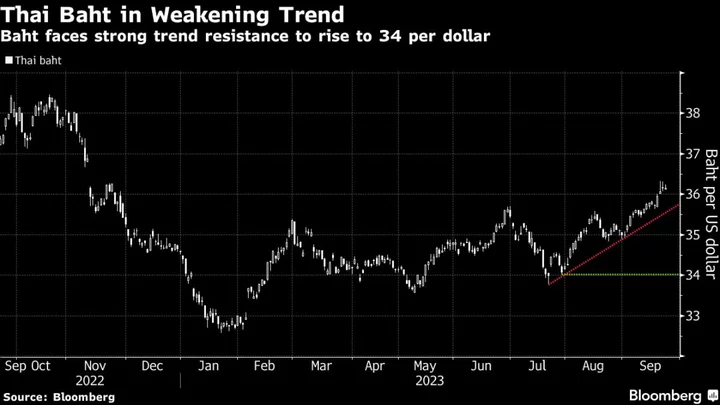

Strategists at Ebury and Societe Generale SA expect the nation’s currency to rally to 34 per dollar by year-end, which is more than 5% stronger than current levels. A stable baht in turn would support sovereign debt and ease pressure on local stocks, according to Krungsri Securities Co.

“A lot of the country-specific risks have receded in recent weeks/months, starting with the resolution to political uncertainty, following that up promptly with passing of measures to improve consumption and tourism,” said Vijay Kannan, a macro strategist at SocGen in Singapore. “If risk sentiment improves from the context of US interest rates receding a bit, then baht should rally.”

The Thai baht has fallen 2.8% in September to be the worst-performing currency in Asia, while the nation’s sovereign bonds have also underperformed. That’s due to concerns over additional government borrowing for measures including provision of some cost-of-living relief for Thai citizens announced by Srettha’s cabinet since he came to power last month.

While fiscal concerns will weigh on the baht in the near term, “it does not dim our medium-term constructive outlook on the currency,” Maybank strategists led by Saktiandi Supaat wrote in a note last week. “Growth could likely come out stronger amid the return of more tourists and the new government’s pro-growth policies.”

Srettha, who is seeking to boost Thailand’s growth to 5% or higher during his term ordered a cut in retail prices of electricity and diesel, approved a moratorium on payment of interest and principal on loans taken by farmers and small businesses for a three-year period. The tourism-reliant nation also agreed to waive visa requirements for travelers from China and Kazakhstan for five months starting Sept. 25.

“We believe that the recent selloff has been excessive and that a near-term rebound against the US dollar may be on the cards,” said Matthew Ryan, head of market strategy at Ebury. Thailand’s current account is supportive of the baht while the nation’s real rates have turned firmly positive, he said.

Bank of Thailand may provide another tailwind for the currency if it hikes its key rate by 25 basis points to 2.5% on Sept. 27, as forecast by economists in a Bloomberg survey. BOT Governor Sethaput Suthiwartnarueput had earlier this month flagged upside risk to inflation from rising energy and food prices.

Here are the key Asian economic data due this week:

- Monday, Sept. 25: Singapore Aug. CPI

- Tuesday, Sept. 26: Singapore Aug. industrial production; South Korea consumer confidence

- Wednesday, Sept. 27: Australia Aug. CPI; Bank of Thailand rate decision; South Korea business surveys; Bank of Japan July meeting minutes; China industrial profits

- Thursday, Sept. 28: Australia Aug. retail sales; NZ business confidence

- Friday, Sept. 29: NZ consumer confidence; Thailand current account and trade balance; Japan jobs and Tokyo Sept. CPI; India 2Q BoP current account balance

Author: Matthew Burgess and Karl Lester M. Yap