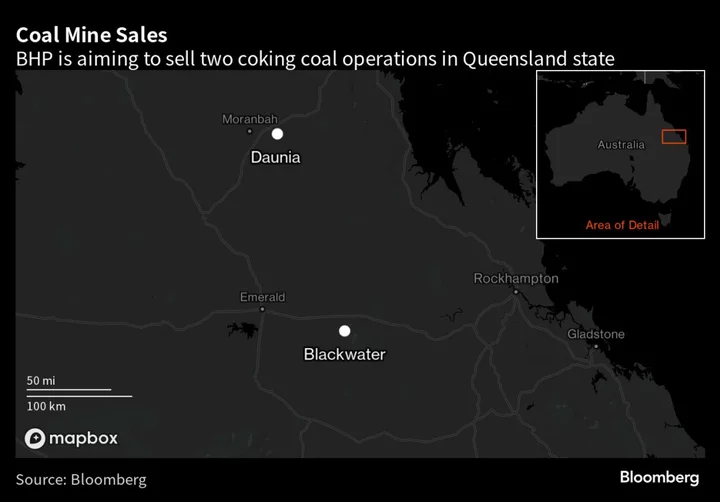

BHP Group Ltd., the world’s biggest miner, said it agreed to sell two more Australian coking coal operations to Whitehaven Coal Ltd. as it extends its withdrawal from fossil fuels.

Spokespeople for the companies declined to offer further details on the size of the sale. Whitehaven was placed in a trading halt in early Australian hours Wednesday, before BHP released a statement in its quarterly production report confirming the sale.

Read More: BHP’s Iron Ore Output Falls 4% as It Confirms Coal Mine Sale

BHP co-owns the mines in a 50:50 joint venture with Mitsubishi Corp., supplying metallurgical coal to steelmakers in markets including China and India. The bidding process for the two mines drew competition from rivals including Indonesia-based mining contractor Bukit Makmur Mandiri Utama PT, Stanmore Resources Ltd. and Peabody Energy Corp.

Since 2021, Melbourne-based BHP has announced sales of coal, oil and gas assets in locations including Australia, the US and Colombia under Chief Executive Officer Mike Henry’s strategy to refocus the producer’s portfolio on materials tied to growth in renewable energy, electric vehicles and agriculture. BHP this year completed its biggest deal in more than a decade to add OZ Minerals Ltd. and boost volumes of copper, a key transition metal.

Henry has also focused on shedding costlier mines and argues BHP should only retain its highest-quality metallurgical coal operations which can potentially help customers limit some emissions in the steelmaking process. Royalties on output imposed by Queensland’s government mean the coal mines are unlikely to win major investment in the future, he previously said.

BHP will be the No. 3 supplier of the material after completing the sales and could seek to exit its stakes in remaining assets, Liberum Capital Ltd. said in a Sept. 20 note.

Read more: BHP Plans to Keep Remaining Coal After Completing Mine Sales

The producer has no current plans to consider sales of other Queensland coking coal operations, Chief Development Officer Johan van Jaarsveld said Oct. 5 in Melbourne.

(Updates with details throughout)