From small restaurants to high-tech companies and a major gas field run by Chevron Corp., Israeli businesses are being convulsed by the war against Hamas.

Many are comparing the shutdowns that have hammered the $520 billion economy to the Covid-19 pandemic, with schools, offices and building sites emptying or opening for only a few hours a day. Israel mobilized a record 350,000 reservists before its ground offensive on Gaza, draining roughly 8% of the workforce.

The military call-ups and partial economic freeze have triggered a sudden crash in activity and upended everything from banking to agriculture. They’re costing the government the equivalent of $2.5 billion a month, according to Mizrahi-Tefahot, a top Israeli lender. The central bank’s warned the impact will worsen the longer the conflict lasts.

Israel declared war on Hamas when it rampaged through southern communities on Oct. 7, killing around 1,400 people. Thousands of Palestinians have died in retaliatory airstrikes on Gaza, the Mediterranean enclave ruled by Hamas.

The financial toll is already severe. Israeli stocks are world’s worst performers since fighting erupted. The main index in Tel Aviv is down 16% in dollar terms, with almost $25 billion wiped off its value.

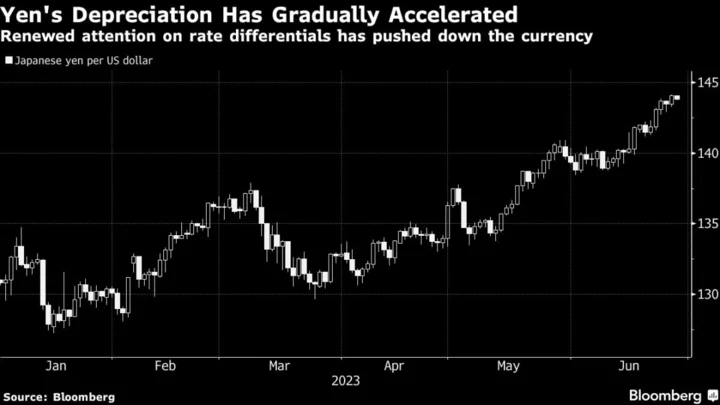

The shekel has slumped to its weakest level since 2012 — despite the central bank announcing an unprecedented $45 billion package to defend it — and is heading for its worst yearly performance this century. The cost of hedging against further losses has soared.

For Naama Zedakihu, who owns two restaurants in Modi’in, a town between Jerusalem and Tel Aviv, the crisis has left her contemplating temporarily laying off her 70 employees.

“I tried opening the restaurants for the first time after two and half weeks but it’s empty so I’ll close early,” she said on Oct. 24. “Deliveries are not enough to sustain the business.”

The geographical reach and duration of the conflict will determine the extent of its long-term economic impact. Prime Minister Benjamin Netanyahu warned of a “long and difficult” military campaign on Saturday as Israel started its widely-expected incursion into Gaza.

JPMorgan Chase & Co. predicts the Israeli economy will shrink 11% this quarter on an annualized basis.

Israel’s recent conflicts — including one in 2006 with Lebanon-based Hezbollah and another with Hamas in 2014 that lasted around seven weeks and included a ground assault on Gaza — “barely affected activity,” JPMorgan analysts said on Oct. 27. But “the current war has had a much larger impact on domestic security and confidence.”

Resilience Tested

The initial disruption has been so severe that only 12% of Israeli manufacturers were at full-scale production after two weeks of war, a survey found. Most cited staff shortages as their biggest problem.

The war will test Israel’s resilience to the limit. The government has said its fiscal deficits may more than double this year and next from previous forecasts. S&P Global Ratings, Moody’s Investors Service and Fitch Ratings have all issued warnings about the outlook for the country’s debt, bringing it closer to a first-ever downgrade.

Israel has restricted work, closed down schools and limited indoor gatherings to 50 people throughout much of the country. And when skirmishes started with Hezbollah, another Iran-backed militant group, on Israel’s northern border, many villages and towns in the area were evacuated. Between there and the communities around Gaza to the south, more than 120,000 Israelis have been forced to leave their homes.

Spending by households has collapsed, dealing a major shock to the consumer sector that accounts for about half of gross domestic product.

Private consumption fell by nearly a third in the days after the war broke out, relative to an average week in 2023, according to the Shva payments-system clearinghouse. Expenditure on items such as leisure and entertainment plunged as much as 70%.

By one measure, the decline in credit-card purchases was more dire than what Israel experienced at the height of the pandemic in 2020, according to Tel Aviv-based Bank Leumi.

“Entire industries and their offshoots cannot work,” said Roee Cohen, head of a federation of small businesses. “Most employers have already decided to place staff on unpaid leave, affecting hundreds of thousands of workers.”

Tech Boom

Israel entered its worst armed conflict in 50 years with an economy that had been turbocharged by technology exports and offshore natural gas finds over the past two decades. GDP per capita rose almost to $55,000, overtaking the likes of the UK, France and Germany.

The wealth transformed the government’s finances and led to years and years of current-account surpluses. That allowed the central bank to amass around $200 billion in reserves, a roughly sevenfold increase since 2008.

Hedge Funders Drive Protests in Battle Over Israeli High Court

Some of the shine began to fade this year when plans by Netanyahu’s coalition — the most right-wing in Israel’s history — to weaken the power of the judiciary triggered mass protests and deterred foreign investment.

Now, as war planning and security dominate the government’s agenda, pressure for economic relief is building. Finance Minister Bezalel Smotrich pledged a bigger stimulus than that during the coronavirus pandemic.

But lawmakers and business owners have criticized the support program — originally set at 4.5 billion shekels ($1.1 billion) for October and possibly more than triple that for later — as insufficient. The economic cost of the conflict will probably run to at least 27 billion shekels, according to Bank Hapoalim, or 1.5% of Israel’s GDP.

Israel’s central bank downgraded its outlook for the economy on Oct. 23, but still forecasts growth in excess of 2% this year and next — assuming the conflict is contained. “The Israeli economy is in a good state and has proven high sustainability,” said Asher Blass, a former chief economist at the Bank of Israel.

Construction Woes

A snapshot of the housing sector offers a more alarming glimpse of what may be coming.

Even as some construction sites reopen, many workers are missing. The industry is heavily reliant on 80,000 Palestinians living in the West Bank, an area that’s been under a security lockdown since mid-September and where unrest’s grown since Israel’s airstrikes and near-total blockade on Gaza began.

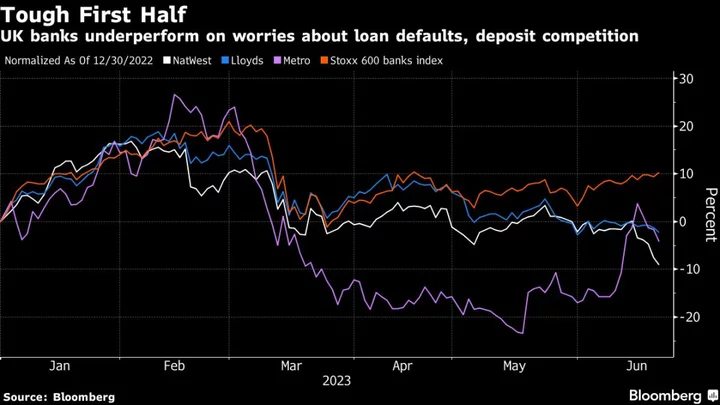

Builders’ finances were already stretched by a rise in interest rates since early last year. Many companies may find it becomes even harder to meet their obligations. It’s a worrying prospect for banks, for whom the construction industry accounts for roughly half their commercial loans.

Military Call-up

A halt in construction and real estate, which contribute 6% to Israel’s tax revenues, will stunt government income and could spark a renewed price surge in a housing market that’s been among the most expensive in Europe and the Middle East in recent years.

As the economy shifts to a war footing, employee departures are also upending technology companies.

About 15% of Israel’s tech workforce has been called up for reserve duty, estimates Avi Hasson, chief executive officer of Startup Nation Central, a non-profit group that tracks the industry. Those numbers are even higher at startups, which tend to employ younger workers, he said.

Lior Wayn, chief executive officer of Mica, an artificial intelligence firm specializing in mammography analysis, said he’s trying to keep operations as normal as possible after several employees were affected by the attacks.

“Two cousins of one of our employees were kidnapped to Gaza,” he said. “Another employee has been on reserve duty for nearly three weeks. My co-founder is in Cyprus because they don’t have a proper bomb shelter at home.”

Investment Delayed

Among 500 high-tech companies surveyed last week, nearly half reported a cancellation or delay of an investment agreement. Among the respondents that include locally-owned and multinational businesses, over 70% said significant projects are being postponed or scrapped.

Even as companies say they are learning to adapt, the plight of many businesses suggests the crisis may leave longer-lasting scars across Israel’s economy.

This reality is dawning on Yiftah Dekel, CEO of Gvaram Industries, a producer of office supplies established in 1979.

Dekel, who’s stayed at a kibbutz just 10 kilometers (6.2 miles) north of Gaza, said less than a quarter of his 65 employees come to work. The area has become isolated and orders for his products are drying up, he said.

“The most acute question” is whether the region near Gaza has a future at all, he said. “We have been through endless attacks and military operations, but this is unlike anything else.”

--With assistance from Marissa Newman and Kerim Karakaya.