Vietnam’s stocks rose, with the benchmark index on track to close at its highest level in more than eight months, as easing monetary policy and government efforts to boost the economy brighten the outlook for the nation’s equities.

The benchmark VN Index rose 0.3% as of 9:45am local time Tuesday to 1,119.11, taking gains in the measure from its November low to over 20%. Sieu Thanh JSC, Nam Song Hau Trading Investing Petroleum JSC and TMT Automobile JSC are among components that have enjoyed the biggest gains this year. The gauge is still well off its record close 1,528.57 from Jan. 6, 2022.

Factors are converging to help fuel the gains. The State Bank of Vietnam late last month cut the refinancing rate to 5% from 5.5% to boost the struggling economy, continuing a spate of measures that reverse the monetary tightening implemented last year. It has vowed to keep pressuring lenders to lower loan rates. Also, the government will consider more measures to support businesses amid the economic recovery, investment and planning minister Nguyen Chi Dung told lawmakers earlier this month.

“The key reason for the recent rally is the back to back interest rates cuts by the central bank as well as lower deposit rates at the banks which is leading to some liquidity coming back to the stock market,” said Ruchir Desai, co-fund manager of the AFC Asia Frontier Fund. “Earnings bottoming out by end of 2023 and the central bank being more dovish going forward can lead to a sustained rally going into 2024.”

Read more on Vietnam’s Rally:

Vietnam Cuts Key Policy Rate to Quicken Economic Recovery

Vietnam Govt to Weigh More Measures to Support Businesses

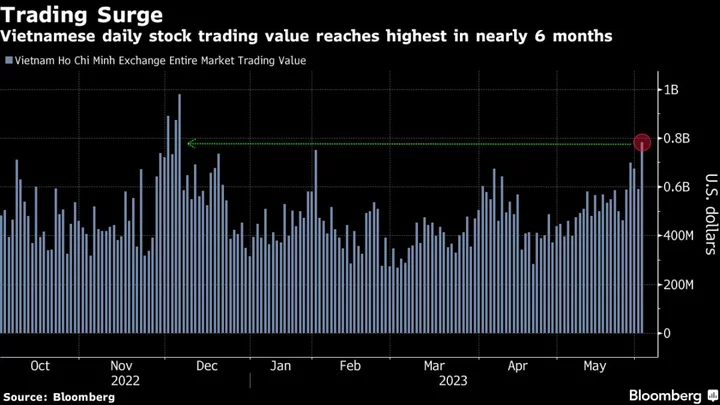

Market dynamics may also be helping. The VN Index topped its 200-day moving average, a trading pattern often seen by technical analysts as a bullish sign, on June 1. And cash flow has come back to the market, with the average daily trading value for Vietnamese stocks increased to more than $1 billion on June 8 - the highest level since April last year, according to data compiled by Bloomberg.